How to get Moniepoint POS machine: Moniepoint POS charges, price, Daily Target.

Moniepoint POS is a mobile money operator in Nigeria that facilitates transactions using Point of Sale (POS) machines, similar to other companies like OPay, Access Clossa, UBA, Kudi, and MoMo Agent. If you’re interested in obtaining a Moniepoint POS, contact a distributor to apply for one. The cost is ₦28,000.

These POS devices are only distributed to licensed and vetted agents who have gone through a rigorous Know Your Customer (KYC) process. Moniepoint and other POS merchants in Nigeria have implemented various measures to ensure the safety and security of these devices.

Moniepoint’s mission is to provide employment opportunities for young people who are currently unemployed by empowering them to become mini-banks that anyone in their vicinity can easily access for transactions, just as they would in a regular bank.

Launched by a Nigeria-based Fintech startup, Moniepoint POS is expanding its services to other parts of Africa. If you’re curious to learn more about Moniepoint POS, stay tuned to this page!

Requirements for Applying for a Moniepoint POS

If you are a business owner and want a Moniepoint POS for your business, you need to meet certain requirements to qualify for a Moniepoint POS. Below is a list of requirements you need to meet to register to open a Moniepoint store:

- Business registration: You must have your business registered with the Corporate Affairs Commission (CAC) in Nigeria. Moniepoint requires you to provide CAC documents to confirm that you are a legitimate business.

- Valid means of identification: You must have valid means of identification. A driver’s license, international passport, or national ID card will meet this requirement. This is necessary to identify you as the business owner.

- Business location: Your business must be located in the area where Moniepoint operates. You can visit their website to check if their service covers your location or not.

- Minimum trading volume: Moniepoint requires you to earn a minimum of 500,000 NGN per month. This is to ensure that you can afford the transaction fees charged by Moniepoint when using their POS service.

- Bank account: You must have a bank account with any bank in Nigeria. This account will be linked to your POS machine to facilitate the transaction process.

- POS Activation Fee: You need to pay a one-time activation fee of NGN 10,000 per POS machine. This fee is non-refundable and must be paid before your POS can be activated.

How to Apply for Moniepoint POS machine

Follow the step-by-step guide below to apply for a Moniepoint POS machine.

- Visit Moniepoint website: To register a Moniepoint POS machine, visit their official website.

- Click “Get Started”: Once on the website, click the “Get Started” button. This will take you to the login page.

- Create an account: Create an account if you are a new user. Provide your full name, valid email address, and phone number.

- Login: After creating the account, log in to the Moniepoint website using your registered email address and password.

- Click on “Request PoS Machine”: Once logged in, you will see the “Request POS Machine” option on the page. Click on it to start the application process.

- Fill out the form: The form will ask you to enter some basic information about your business such as name, company name, business address, phone number, and other requested details.

- Submit documents: You will be required to submit some documents to complete the application process. These include a valid means of identification, a business registration certificate, and bank statement.

- Wait for approval: After submitting your application, Moniepoint will review it and get back to you within a few business days. If your request is approved, the POS machine will be delivered to your business address.

- Install and activate the POS machine: After receiving the POS machine, install and activate it. Follow the instructions in the user manual to configure it.

- Start accepting payments: After installing and activating the POS machine, start accepting payments from customers. Moniepoint provides a fast and secure payment processing system that enables seamless transactions.

Understanding Moniepoint Policy

Moniepoint Policy and Agreement Form

Are you interested in purchasing a Moniepoint POS device? Here are some important things you need to know before purchasing:

- Moniepoint POS devices are not for sale. They remain company property.

- The rented POS terminal must be used daily. If not, the company will be able to recover it.

- Moniepoint agents are expected to reach a daily withdrawal target of 50,000, Monday to Saturday. Additionally, weekly performance must not fall below 150,000. Failure to comply with this requirement may result in reinstatement of the POS device.

- The agent must agree to return the POS when it is no longer in use (due to leaving the company or due to other financial problems).

- On return from the POS terminal, agents will be reimbursed N10,000.

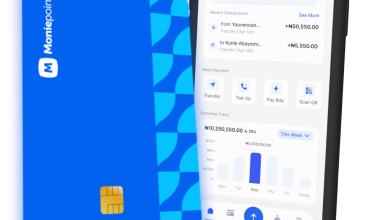

Type of Moniepoint POS and their Price

Moniepoint is one of the leading PoS machine suppliers in Nigeria and offers a wide range of products to suit your business needs. Here are the types of Moniepoint PoS machines and prices:

- Moniepoint GPRS PoS machine – This type of PoS machine uses a 2G/3G SIM to connect to the Internet and process transactions. It has a portable design, and long-lasting battery, and accepts payments by cards, wallets, and QR codes. It costs N35,000.

- Moniepoint Bluetooth PoS Machine – This PoS machine uses Bluetooth technology to connect to your mobile device and process payments. It’s compact, lightweight, and accepts payments by cards, wallets, and QR codes. The Moniepoint Bluetooth PoS machine costs N28,000.

- Moniepoint Desktop PoS Machine – This type of PoS machine is designed for businesses that need a fixed payment terminal. It has a large screen, and user-friendly interface, and accepts payments by cards, wallets, and QR codes. The Moniepoint desktop PoS machine costs N60,000.

All Moniepoint PoS machines come with a 1-year warranty, free software updates, and 24/7 technical support. Additionally, you will have to pay a monthly rental fee of N1,000 or N2,000, depending on the type of PoS machine you choose.

Moniepoint POS charges and commission structure

Moniepoints POS charges depend on the volume of transactions made through their terminal, but here’s an overview of their commissions and fees as a beginner’s guide:

- For withdrawals between N1 and N20,000, Moniepoint POS only charges 0.5% of the transaction amount.

- For transactions above N20,000, Moniepoint charges a flat rate of N100 (subject to change).

- For transfers, Moneypoint POS charges a flat rate of N20 per transaction.

Regarding data top-ups, Moneypoint POS charges the following commission rates:

– MTN: 3%

– Glo: 4%

– 9Mobile: 4.5%

– Airtel: 4%

For TV subscription payments, Moneypoint POS charges a 2% commission fee for the following providers:

– DSTv

– GOTv

– PHCN

– Star Times.

FAQ on How to get Moniepoint POS machine, charges, price, and Daily Target.

1. How do I get a Moniepoint POS?

You can find a Moniepoint POS distributor by visiting their website or contacting their customer service team. They will guide you through the registration process and provide you with the necessary documents.

2. What are the costs associated with a Moniepoint POS machine?

Moniepoint charges a one-time fee of N28,000 for their POS machines and there are no hidden or additional fees.

3. What is the price of a Moniepoint distributor?

The cost of a Moniepoint POS machine is N50,000, which includes the cost of hardware and software required to operate the machine.

4. What is the daily purpose of a Moniepoint POS machine?

Moniepoint does not have daily targets for its POS machines. However, they have a profit-sharing model that allows merchants to earn commissions on transactions made through their POS machines.

5. How long does it take to receive the Moniepoint POS after requesting it?

Moniepoint typically processes orders from POS machines within 1-2 business days. However, processing times may vary depending on machine availability in your area.

Conclusion:

Getting a Moniepoint ATM POS for your business is a simple process that requires a one-time payment of N50,000. There are no hidden fees or additional fees and merchants can earn commissions on transactions made through their POS machines. Ordering a Moniepoint POS is the first step towards modernizing your business and increasing your revenue.