How to Apply for a Loan in 2023 (A Step-by-Step Guide)

How to Apply for a Loan: Are you in need of financial assistance to fulfill your dreams or tackle unexpected expenses? Applying for a loan can provide you with the necessary funds to meet your goals.

Whether it’s for personal reasons, buying a home, or starting a business, understanding the loan application process is crucial to ensure a smooth experience.

In this article, we will guide you through the steps of applying for a loan and provide valuable tips for a successful application.

Types of Loans Available

Before diving into the loan application process, let’s explore the different types of loans available. Understanding the options will help you determine which loan suits your needs the best.

Personal loans

Personal loans are unsecured loans that individuals can obtain from banks, credit unions, or online lenders. They are versatile and can be used for various purposes, such as consolidating debt, financing a vacation, or covering medical expenses. Personal loans usually have fixed interest rates and repayment terms.

Mortgage loans

Mortgage loans are specifically designed for purchasing or refinancing a home. They are secured loans, where the property serves as collateral for the loan. Mortgage loans come with different types, including fixed-rate mortgages and adjustable-rate mortgages (ARMs). The loan term can range from 15 to 30 years, depending on the borrower’s preference.

Business loans

Business loans cater to entrepreneurs and business owners who require funds to start, expand, or sustain their ventures. These loans can be secured or unsecured, depending on the lender’s requirements. Business loans often have specific terms and conditions tailored to the needs of the business, such as equipment financing, working capital loans, or commercial real estate loans.

Factors to consider before applying for a loan

Before applying for a loan, several factors should be taken into account to increase your chances of approval and secure favorable terms.

Credit score and financial history

Lenders assess your creditworthiness through your credit score and financial history. A higher credit score indicates a lower risk for lenders, making it easier to secure a loan with better interest rates and terms. Review your credit report, address any errors, and consider improving your credit score before applying for a loan.

Interest rates and terms

Compare interest rates and loan terms offered by different lenders. A lower interest rate can save you money over the life of the loan, while favorable terms can provide flexibility in repayment. Carefully analyze the Annual Percentage Rate (APR), which includes both the interest rate and other fees associated with the loan.

Loan amount and repayment period

Determine the loan amount you need and choose a repayment period that aligns with your financial goals. While a longer repayment period may result in lower monthly payments, it can also lead to paying more interest over time. Assess your financial situation and select a loan amount and repayment period that suits your budget and future plans.

Steps to Apply for a Loan

Now that you understand the types of loans and factors to consider, let’s delve into the step-by-step process of applying for a loan.

Research and compare lenders

Start by researching different lenders and their loan offerings. Look for reputable institutions with positive customer reviews and competitive interest rates. Compare the terms, fees, and requirements of multiple lenders to find the one that best fits your needs.

Gather required documents

Lenders typically require certain documents during the loan application process. These may include identification proof, income verification, bank statements, tax returns, and other supporting documents. Gather all the necessary paperwork to streamline the application process.

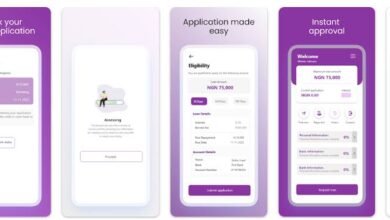

Complete the loan application

Once you have selected a lender, complete the loan application accurately and provide all the requested information. Double-check the form for any errors or missing details that could delay the approval process. Be prepared to provide additional documents or answer any follow-up questions from the lender.

Wait for approval and funding

After submitting your loan application, the lender will review your information and assess your eligibility. This process may involve a credit check and verification of the documents provided. Depending on the loan type and lender’s processes, the approval and funding timeframes can vary. Stay in touch with the lender and be patient during this stage.

Tips for a Successful Loan Application

To increase the chances of a successful loan application, consider the following tips:

Improve your credit score

If your credit score is less than ideal, take steps to improve it before applying for a loan. Pay bills on time, reduce credit card balances, and avoid opening new lines of credit. A higher credit score can strengthen your loan application and help you secure better loan terms.

Pay off existing debts

Lenders consider your existing debts when assessing your loan application. Pay off outstanding balances or reduce them as much as possible to demonstrate your financial responsibility and improve your debt-to-income ratio.

Provide accurate information

Be honest and accurate when providing information on your loan application. Lenders may verify the details, and any discrepancies could lead to rejection or delays in the approval process. Ensure that all the information provided aligns with your supporting documents.

Summary

Applying for a loan doesn’t have to be a daunting process. By understanding the types of loans available, considering important factors, and following the step-by-step guide, you can increase your chances of securing the loan you need.

Remember to research lenders, gather the required documents, and complete the application with accurate information. With careful planning and a strong application, you can obtain the financial assistance necessary to achieve your goals.