Palmpay Signup and Registration: How to open Palmpay account, How to make Payments (Send and receive Money) with Palmpay.

How to Make and Receive Payment with Palmpay

Palmpay is a digital payment platform owned by a group of dynamic young entrepreneurs – Samuel Yiğit and Sim Shagaya. Founded in 2019, Palmpay seeks to change the way people pay in Nigeria and across Africa. Samuel Yiğit, a renowned financial expert, and Sim Shagaya, a successful technology entrepreneur passionate about digital innovation, have jointly created a platform that provides efficient, secure and affordable payment services. affordable for people from all walks of life.

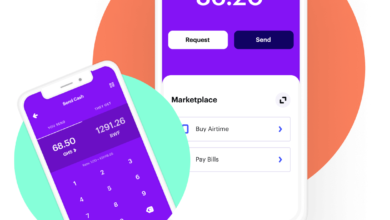

The idea behind Palmpay is to provide a unique, user-friendly and comprehensive digital payment solution, tailored to the needs and habits of Africans. Through the platform, users can easily make payments for goods and services, check account balances, transfer money, and receive payments from anywhere and at any time.

Palmpay also offers attractive incentives and rewards to users to encourage cashless transactions and promote financial inclusion.

With a mission to simplify payments and improve people’s lives, Palmpay has quickly become a popular choice among individuals, businesses and organizations looking for a trusted payment platform in Africa.

Why Palmpay stands out from other payments in Nigeria.

Palmpay is among the leading digital payment platforms in Nigeria. Customers prefer to use Palmpay because of the following reasons.

- User-friendly interface: Palmpay stands out as a fast, intuitive and user-friendly payment platform, designed to appeal to everyone, regardless of their background.

- Fast and safe transactions: Palmpay guarantees fast and secure payments, making it the ideal choice for businesses and individuals who value speed and security.

- Discounts and Cashback: Palmpay offers discounts, cashback and many referral programs to users, helping them save significantly when transacting.

- Integration with financial services: Unlike most payment platforms in Nigeria, Palmpay is integrated with various financial services, allowing users to access lending, insurance and wealth management services from the Palmpay app.

- NFC capabilities: Palmpay enables contactless payments using NFC technology, making in-store or online transactions convenient and secure.

- Customer support service: Palmpay offers 24-hour customer support to its users, ensuring that they can contact and resolve their issues in real-time.

- Seamless User Verification: With Palmpay, you don’t need to fill out lengthy forms or provide lots of identification. User verification is seamless, hassle-free and completed in minutes.

- Availability: Palmpay is available on multiple platforms, including iOS and Android devices, making it accessible to everyone.

- Cooperation with merchants: Palmpay has partnered with thousands of merchants across Nigeria, making it the ideal payment platform for anyone who regularly transacts with local businesses.

- Ability of extension: Palmpay’s scalable and adaptable nature is ideal for businesses of all sizes, providing tailored solutions that can be customized to their unique needs.

Documents needed for Palmpay account opening.

If you want to open palmpay account here are the documents you need .

- Valid identification documents: To open a Palmpay account, you must present a valid government-issued identification document, such as an ID card, driver’s license or international passport. This document provides proof of your identity and helps prevent identity theft and fraud.

- Proof of address: You will be asked to provide proof of your residential address, such as a utility bill or bank statement. This document verifies your current address and is required to successfully register your Palmpay account.

- Identification photo: Your new, clear ID photo is required when creating a Palmpay account. This photo will help you identify yourself when making transactions on the platform.

- Bank verification number (BVN): Your BVN is another mandatory document you must provide when opening a Palmpay account. This number helps link your account with other accounts and ensures that all your transaction records are seamlessly integrated.

- Email address: Palmpay requires you to provide an active email address during the account creation process. This email address is needed to verify your account and send you important updates about your Palmpay account and transactions.

- Phone number: An active phone number is required to create a Palmpay account. This phone number ensures that you can receive SMS alerts and other notifications related to your account activity.

Palmpay Signup and Registration: How to open Palmpay account

To open a Palmpay account, users must follow these steps:

Step 1: Download and install the Palmpay application

First of all, users need to download the Palmpay app from the Google Play Store or Apple App Store and install it on their mobile device.

Step 2: Register

After the installation process, launch the app and click the “Sign Up” button. Enter your phone number by agreeing to the terms and conditions of the Palmpay application. Click the “Next” button to verify your phone number.

Step 3: Verification

To verify your identity, Palmpay’s agent or chatbot will ask for your full name, email address, date of birth and residential address. Users will then need to submit their government-issued ID.

Step 4: Set up a password and PIN

Once verification is complete, you will be prompted to set a password and PIN. /Passwords must be unique /while PIN /codes must be four digits long. 00Users must keep passwords and PINs secure and not share or write them down.

Step 5: Add a bank account

After setting up a password and PIN, users must add a bank account to their Palmpay account. To add a bank account to your Palmpay account, go to the bank icon and select “Add bank account”. Enter your account details and select your bank. You will receive a POP confirmation message to your registered phone number.

Step 6: Fund your Palmpay account

To deposit money into your Palmpay account, go to the “Deposit” option, enter the amount you want to deposit, then select your funding source. Palmpay funding sources include debit or credit cards, USSD, and bank transfers.

Step 7: Perform transaction

Once the account is funded, users can perform transactions such as airtime top-ups, bill payments, money transfers to other Palmpay users, etc. In short, to open a Palmpay account, you need to download the Palmpay app, register, verify your identity, set a password and PIN, add a bank account, fund the account and start trading.

How to Send Money with a Palmpay account.

Palmpay is a mobile wallet that allows users to send and receive money, pay bills, and buy goods and services. Sending money is an important feature of Palmpay, especially when you need to pay someone quickly and easily. It’s safe, fast and convenient. Here’s how to deposit money using your Palmpay account.

- Make sure you have a Palmpay account: If you want to deposit money with Palmpay, you must have a Palmpay account. If you haven’t already, simply download the Palmpay app from the Google Play Store or Apple Store and sign up with your name, phone number and email address. Create a password and confirm your account to start enjoying the benefits of Palmpay.

- Deposit money to your Palmpay account: To deposit money, you must have money in your Palmpay account. Fund your Palmpay account by depositing funds from your bank account, debit/credit card or through Palmpay vouchers. Simply select “Add Money” on the Palmpay app and follow the instructions to fund your account.

- Select recipient: After depositing money into your Palmpay account, select the recipient you want to send the money to. You can search for recipients by their phone number or Palmpay username. Make sure you have the correct recipient information to avoid sending money to the wrong account.

- Enter the amount to send: Next, enter the amount you want to deposit. The minimum amount you can send on Palmpay is N100, you can also add a note to the recipient if you want to explain what the money’s for.

- Confirm transaction: Before sending money, confirm transaction details, including recipient details and amount. Next, enter your Palmpay PIN to authorize the transaction. If the PIN is correct, the transaction will be completed immediately and the amount will be deducted from your Palmpay account.

How to receive Money with Palmpay Account

One of Palmpay’s key features is its ability to allow users to easily receive money from others. In this article, we will show you how to receive money with Palmpay in 6 simple steps.

How to receive money using Palmpay account:

- Make sure your Palmpay account is fully verified: To receive money on Palmpay, you must have a fully verified account. Make sure your account is verified with your BVN, phone number, and email address.

- Provide your Palmpay ID: Your Palmpay ID is your unique identifier on the platform. You can find it by clicking on the “My Palmpay” tab, then selecting “Profile.” Share your Palmpay ID with the person sending you money.

- Ask for money: To receive money on Palmpay, you must request it. Click the “Transfer” button on your Palmpay dashboard, then select “Request”. Enter the amount you want to receive, then click “Request”.

- Wait for payment confirmation: When you request money, the sender will receive a notification. They will need to confirm the payment before it is posted to your account. You will also receive a notification once payment is confirmed.

- Check your Palmpay balance: Once your payment is confirmed, the amount will be credited to your Palmpay account balance. You can check your balance by clicking on the “My Palmpay” tab and selecting “Balance”.

- Withdraw money to bank account: To withdraw money to your bank account, click on the “Wallet” tab, then select “Withdrawal”. Enter the amount you want to withdraw and select the bank account you want. Click “Delete” to complete the process.

FaQs How to open palmpay account/ How to make payments

What are the steps to create a Palmpay account?

To open a Palmpay account, users must download the app, enter their phone number to receive a verification code, and follow the prompts to enter personal information, set a password, and create a PIN.

How do I add funds to my Palmpay wallet to make payments?

To top up your Palmpay account, users have many different options such as bank transfer, payment by card, USSD or using Palmpay vouchers.

Is it possible to transfer money from my Palmpay account to someone else’s account?

Yes, it is possible to transfer money from one Palmpay account to another by selecting the “Payment” option and entering the recipient’s Palmpay ID or phone number.

What is the Palmpay QR code payment option and how does it work?

The Palmpay QR Code payment option works when users scan a merchant’s QR code from their Palmpay app, allowing them to pay for the exact amount of their purchase without the need for cash or card.

How can I keep my Palmpay wallet and transactions safe?

To ensure the security of your Palmpay account, users should set a strong password and PIN and avoid sharing their login information. Users must also enable the phone’s lock screen and Palmpay’s security features such as biometric authentication and two-factor authentication.

Conclusion:

Sending money with Palmpay is simple and straightforward. Make sure you have a Palmpay account, have enough funds, select the correct recipient, enter the correct amount and confirm the transaction. Palmpay gives you the ability to send money from the palm of your hand to anyone, anywhere, anytime. Try it today!