How to Check NIRSAL Loan Approval status with BVN

Check your NIRSAL Loan application status with BVN

Do you wish to check your NIRSAL Loan status with BVN ? We have covered this article for you. Read through to see how you can do that effortlessly.

NIRSAL stands for Nigeria Incentive -Based Risk Sharing System For Agricultural Lending (NIRSAL). It is a government owned organization that is saddled with the responsibility of supporting agriculture, healthcare, and small business in Nigeria by giving out soft and affordable loans to enterprises and individuals who are qualified.

This loan is a low-interest loan with flexible repayment terms and a collateral-free loan, meaning that you don’t need any collateral to access this loan. One important thing you need to know before applying for a NIRSAL Loan is how to check your loan application status.

To check your NIRSAL Loan status, you would need a BVN (Bank Verification Number) number. In this post, we will show you how to check your NIRSAL Loan application status with BVN.

What is NIRSAL Loan?

Are you a farmer, entrepreneur, or agribusiness owner in Nigeria? If so, you may have heard of the NIRSAL loan. The Nigeria Incentive-Based Risk Sharing Program for Agricultural Lending (NIRSAL) is an initiative of the Central Bank of Nigeria to close the financing gap in the agricultural sector by providing management, risk management, and proper monitoring.

NIRSAL loans are designed to support farmers, agribusinesses, and value chain actors. Loans can be used to finance the purchase of seeds, farm equipment, processing facilities and more. NIRSAL loans offer relatively low-interest rates and flexible repayment terms that are accessible to many borrowers.

To apply for a NIRSAL loan, a borrower must meet certain eligibility criteria, including registering with the Corporate Relations Commission (CAC) and having a viable business plan. Applicants must have alternative risk mitigation measures which may include insurance or guarantees.

NIRSAL Loan is a very good development for the agribusiness sector in Nigeria. Its main focus is to provide long-term sustainable solutions to financial challenges faced by farmers and businesses.

With NIRSAL, having access to affordable financing options and other essential support services is vital to the success and growth of any agribusiness.

If you are looking to expand your agribusiness, invest in modern equipment, or improve your farming methods, you should consider applying for a NIRSAL loan.

What is BVN?

BVN, which stands for Bank Verification Number, is a unique identification number issued by the Central Bank of Nigeria (CBN) to people who do banking with Nigerian banks.

BVN is a biometrics system that captures somebody’s fingerprints, photos, and other bio-data. The personal information collected is used to improve the security of banking transactions which in turn reduces fraud.

BVN was introduced in 2014 as part of a broader effort to strengthen the Nigerian banking system. Since its inception, BVN has become mandatory for the opening of any new bank account in Nigeria, as well as for individuals to transact using their existing bank accounts.

The BVN system was created to provide a unique identification system that can be used in all banks in Nigeria. Before the BVN system was born, there was no unified identification system for customers, making it difficult to monitor and track fraudulent transactions.

To register for BVN, individuals must submit their biometric data to their bank, which then transfers the information to the CBN for processing. You only need a single BVN number, this is because all your accounts are linked to one BVN.

How to Check NIRSAL Loan with BVN

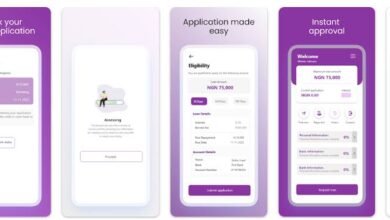

In this section, we will show you how to check your NIRSAL Loan with your BVN. You should be aware that before you can check your NIRSAL Loan application status with BVN, you must be registered and apply for a loan on the NMFB platform. If you have already done that, let’s proceed.

If you are one of the many Nigerians eagerly awaiting the disbursement of NIRSAL COVID-19 loans, you will want to know how to check the status of your loan application. Fortunately, it’s really a simple process. Here’s what you need to do:

- Visit the NIRSAL Microfinance Bank (NMFB) website at https://nmfb.com.ng/covid-19-support/.

- Find the “Check loan application status” link on the page and click it. You will be directed to another page.

- On the new page, enter your Bank Verification Number (BVN) in the required field and click the “Submit” button.

- If your application is approved and your loan is ready to be disbursed, you will receive a “Congratulations! Your loan has been approved.” You will also receive information on how to proceed with receiving your funds.

- If your request is still being processed, you will receive a message saying “Your request is being processed. Please try again later. »

It is important to note that NIRSAL Covid-19 loans are only available to small and medium-sized businesses (SMEs), households, and individuals whose livelihoods have been negatively impacted by the pandemic. You must have a valid BVN and meet other eligibility criteria to apply.

Tips for Successful NIRSAL Loan Application

As someone seeking financial assistance from NIRSAL, it is important to know how to successfully apply for a loan. Below are some beneficial tips that can help you through the process:

- Have a clear business plan:

Before applying for the NIRSAL loan, make sure you have a solid business plan in place. This usually includes projecting your business income, and expenses and well-detailed information about your business venture.

- Meet the NIRSAL Loan requirements:

Make sure you meet all the necessary conditions for the loan. This includes, among other things, having an active business with a good credit rating.

- Select the right loan:

NIRSAL offers a variety of loan products, each with its own requirements. Choose the one that best suits your needs and your ability to return.

- Prepare documents:

Make sure you have prepared and organized all the necessary documents when applying for a NIRSAL loan. This includes documents such as your business registration documents, tax returns, and your bank account statements. CAC certificate.

- Be honest: When completing your loan application, be sure to be honest about your business’s financial situation. This will help the NIRSAL to make an appropriate decision about whether or not to approve your loan.

By adhering to these tips, you might increase your chances of successfully applying for a NIRSAL loan.

FAQs on NIRSAL Loan Application check with BVN

1. How can I check the approval status of my BVN NIRSAL loan?

You can easily check the approval status of your BVN NIRSAL loan by visiting the official NIRSAL Microfinance Bank loan portal and entering your BVN number.

2. Is it possible to check my NIRSAL loan approval status without a BVN number?

No, it is not possible to check your NIRSAL loan approval status without a BVN number. Your BVN serves as a unique identifier in the loan application process and is required to access the loan portal.

3. How long does it take to get loan approval after applying through NIRSAL?

Processing time for loan approval after applying through NIRSAL varies but usually takes 5-10 business days. You will receive an email notification when your loan is approved or denied.

4. Can I appeal a denied loan application through NIRSAL?

Yes, you can appeal a denied loan application through NIRSAL by submitting a written complaint stating your case and providing any additional documentation supporting your request.

5. Are there any fees associated with verifying your NIRSAL loan approval status using your BVN number?

No, there is no fee associated with verifying the NIRSAL loan approval status with your BVN number. The loan portal is free to access and check the status of your application at any time.

Conclusion

Following our guidance on checking your NIRSAL Loan application status with BVN, you will discover that it is very easy and simple. By following the steps above you will see your NIRSAL Loan application status within a few minutes. The status check is free of charge.

To increase your chance of getting the NIRSAL loan, you would also need to adhere to these tips, meet the eligible requirements, have a clear and viable business plan, gather all the necessary documents, and overall have a good credit score.