Kuda Bank Loan: How to apply for Kuda Bank Loan and Borrow Money from Kuda Bank App

Kuda Bank is a revolutionary banking solution designed to meet your financial needs with ease and convenience. Owned by Babs Ogundeyi and Musty Mustapha, Kuda Bank was founded in 2019, with a mission to create a future where banking is easy and rewarding. With Kuda Bank, you have access to many benefits, including zero account fees, free ATM withdrawals, competitive interest rates, and a user-friendly mobile app.

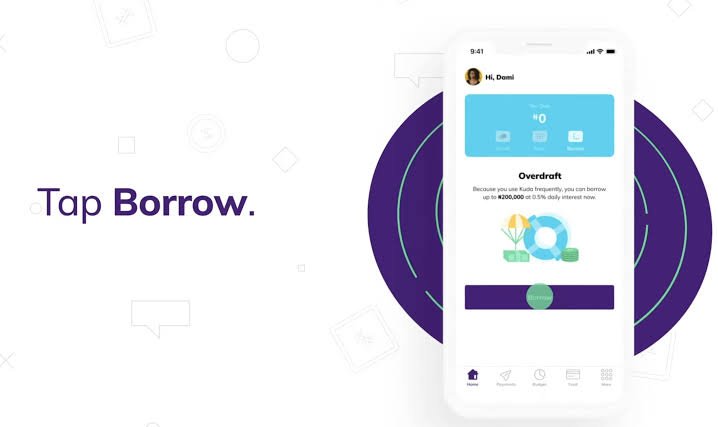

We can confidently tell you that Kuda Bank is the right platform for people who are looking for efficient banking services without compromising their time and resources. With Kuda Bank Loan, you can access quick and stress-free loans from ₦1,000 to ₦200,000, payable in 6 months at affordable interest rates. Whether you want to fund your business, pay bills, or handle emergencies, Kuda Bank Loan can help you.

Why look for another bank?, when you can have it all with Kuda Bank? Explore a new banking model with Kuda Bank. Join the community today and easily change your financial future.

Kuda Bank Loan: Type of loan

Kuda Bank offers many different types of loans to meet the diverse needs of customers. Below are some loan types and corresponding interest rates:

- Salary advance: This type of loan allows you to access up to 50% of your monthly salary before payday. The interest rate is 3.5%/month.

- Personal loan: You can get a personal loan from Kuda Bank to meet urgent financial needs like medical expenses, rent, tuition, etc. The interest rate is 4.5%/month.

- Business loan: Kuda Bank offers business loans to entrepreneurs and small business owners to start or expand their businesses. Interest rates vary depending on the loan amount and the business’s credit reputation.

- Travel loan: If you are planning a trip and need financial assistance, Kuda Bank offers travel loans with an interest rate of 5% per month.

- Asset financing: Kuda Bank provides asset financing to help customers purchase vehicles, equipment, and other assets. The interest rate is 5%/month.

- Medical loan: Medical emergencies can be quite burdensome and that is why Kuda Bank offers medical loans at 4.5% interest per month to help you cover your expenses.

Kuda Bank Loan Requirements

List of Kuda Bank loan requirements:

- Credit score: Kuda Bank requires you to have a good credit score. This means you must be able to demonstrate good credit behavior, such as paying bills on time and avoiding default.

- Source of income: Kuda Bank will also require proof of income to ensure you can repay the loan. You can provide this in the form of your payslip or bank statement.

- KYC Documentation: Kuda Bank requires that you provide proof of identification such as a driver’s license, national ID card or international passport.

- Loan Purpose: Kuda Bank will require that you state the reason for the loan so they can evaluate the risk and determine your eligibility.

- Guarantor: Kuda Bank may require a guarantor to co-sign a loan contract to secure the loan.

How to apply for a Kuda Bank Loan and Borrow Money from Kuda Bank App.

If you want to borrow money from Kuda Bank follow the steps below.

- To apply for a loan and borrow money from the Kuda Bank application, I recommend downloading the application from the app store on your device.

- After downloading and installing the Kuda Bank app, launch it on your device. Make sure you have Internet access and enter your credentials to access the application dashboard.

- Locate and tap on the “loan” option in the app dashboard.

- Select the type of loan you want to apply for and click “Apply for a loan”.

- Enter accurate and updated information in the loan application form. Make sure your information is complete and accurate; Otherwise, your loan may be rejected.

- If your loan application is successful, you will soon receive a notification from Kuda Bank about the status of your application.

- Once your loan is approved, the money will be deposited into your Kuda bank account.

- To repay your loan, go to the loans section of your dashboard, select the loan you want to repay, and follow the instructions on the repayment page.

- You can also repay your loan by setting up an automatic repayment plan from your Kuda Bank account.

- Applying for a loan and borrowing money from the Kuda Bank App is a simple process. Make sure you have accurate and up-to-date information when filling out the loan application form.

Kuda Bank loan repayment plan.

Repayment plans at Kuda Bank are designed to ensure maximum convenience and flexibility for customers.”

After the loan is successfully disbursed, you can choose between two repayment options: monthly payment plan or one-time payment plan.”

- The monthly payment option requires you to repay the loan and accrued interest over a period of six months. You can make payments through our mobile banking app or visit one of our branches closest to you.

- For customers who choose the one-time repayment option, repayments will be spread over a 12-month period. This option allows you to pay much less each month but has a high total credit cost than the monthly payment option.”

If customers are having difficulty meeting their repayment schedule, they should contact our customer service team, who will work with them to come up with a feasible repayment plan.”

FAQs How to apply for a loan and Borrow Money from Kuda Bank App.

How to apply for a loan from the Kuda Bank app?

To apply for a loan, you just need to download the Kuda Bank application from the App Store or Google Play Store and register with your BVN. Once logged in, navigate to the “Loans” section of the app and follow the simple steps to apply for a loan.

What loan amounts are available on the Kuda Bank app?

Kuda Bank offers loans ranging from N1,000 to N200,000 for individuals and N500,000 to N3,000,000 for businesses. The specific loan amount for which you qualify will be determined based on your credit score and financial profile.

What is Kuda Bank’s loan interest rate?

Kuda Bank loan interest rates range from 1.75% to 3.75%/month depending on the loan amount and your repayment term. Competitive and transparent interest rates, no hidden fees or charges.

How long does it take to receive a loan from the Kuda Bank application?

Kuda Bank loan applications are usually processed within 24 hours and if approved, the loan will be disbursed to your account immediately. However, the time it takes to receive a loan may vary depending on the accuracy of the information, loan type, and other factors.

What are the requirements to qualify for a loan on the Kuda Bank application?

To qualify for a loan from Kuda Bank, you must have a verifiable source of income, be over 18 years old, have a BVN, and have a valid Nigerian bank account. Additionally, your credit score, repayment history, and other factors may also be considered during the loan evaluation process.

Conclusion

Kuda Bank is a soft loan that can be used for personal purposes, or business purposes. The repayment plan is favorable and the interest rate is affordable. However, you will need to do your own research based on your specific needs to be able to make an informed decision.