What Companies Are In The Finance Field? Top 10 finance companies 2023

What Companies Are In The Finance Field: Finance is a vast field that encompasses a wide range of companies and organizations. From banks and insurance companies to investment firms and credit rating agencies, the finance industry is made up of a diverse group of entities that all play a critical role in the global economy.

The finance field is a diverse and dynamic industry that encompasses a wide range of companies and organizations. From traditional banks and investment firms to newer fintech startups and online lenders, the finance field is constantly evolving to meet the changing needs of consumers and businesses.

What Companies Are In The Finance Field?

The finance field includes a wide range of companies and organizations, including:

- Banks

- Insurance companies

- Investment firms

- Credit rating agencies

- Hedge funds

- Private equity firms

- Real estate investment trusts

- Financial technology companies

- Financial advisors

- Stock exchanges

- Credit unions

These entities provide a variety of products and services, such as checking and savings accounts, loans, credit cards, insurance policies, investment management, financial advice, and more. They play a critical role in the global economy by providing the capital and financial services needed for individuals, businesses, and governments to manage their finances and achieve their financial goals.

1. Bank

One of the most well-known and recognizable companies in the finance industry is the bank. Banks are financial institutions that provide a variety of services to individuals, businesses, and government agencies. These services include checking and savings accounts, loans, credit cards, and other financial products and services. Banks also play a crucial role in the economy by providing the capital needed for businesses to grow and expand.

2. Insurance Company

Another major player in the finance industry is the insurance company. Insurance companies provide a wide range of policies that protect individuals and businesses from financial loss due to unexpected events such as accidents, illnesses, and natural disasters. These companies also invest the premiums they collect to generate returns for their shareholders.

3. Investment firms

Investment firms are another important component of the finance industry. These firms manage money on behalf of their clients, including individuals, businesses, and government agencies. They use a variety of strategies, including stock and bond trading, to help their clients achieve their financial goals. Investment firms also provide financial advice and guidance to their clients.

4. Credit rating agencies

Credit rating agencies are also an important part of the finance industry. These agencies evaluate the creditworthiness of companies and governments by assessing their ability to repay debt. They assign ratings to these entities based on their analysis, which helps investors and lenders make informed decisions about the level of risk associated with a particular investment.

5. Hedge funds

Hedge funds are investment vehicles that use various strategies, such as long and short positions, derivatives, and leverage, to generate returns for their investors. These funds are typically only open to accredited investors, due to their high-risk nature.

6. Private equity firms

Private equity firms, on the other hand, focus on buying and growing companies. These firms raise money from limited partners, such as pension funds and endowments, and use that capital to invest in and acquire companies. Once they have control of a company, private equity firms will typically work to improve operations and financials, before eventually selling the company for a profit.

7. Real Estate Investment Trust (REITs)

Real estate investment trusts (REITs) are companies that own, operate, or finance income-producing real estate. REITs are required to distribute at least 90% of their taxable income to shareholders as dividends, making them a popular choice for income-focused investors.

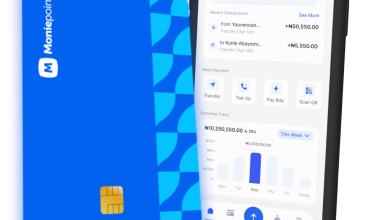

8. Financial technology companies

Financial technology, or fintech, companies are businesses that use technology to make financial services more efficient and accessible. Examples of fintech companies include online lenders, robo-advisors, and mobile payment providers.

9. Financial advisors

Financial advisors are professionals who help individuals and businesses make informed financial decisions. These advisors may specialize in areas such as retirement planning, investment management, or risk management.

10. Stock exchanges

Stock exchanges, such as the NYSE and NASDAQ, are organizations that facilitate the buying and selling of securities. These exchanges provide a centralized marketplace for investors to buy and sell stocks, bonds, and other securities.

These entities, along with many others, all play a vital role in the finance industry by providing the products and services that individuals, businesses, and governments need to manage their finances and achieve their financial goals.

What Jobs are Available in the Finance Field?

- Investment Banking: Investment bankers advise and raise capital for corporations, governments, and other organizations. They help companies with initial public offerings (IPOs) and other securities offerings, and may also be involved in mergers and acquisitions.

- Private Equity: Private equity professionals work for firms that invest in and acquire companies. They may be involved in identifying potential investment opportunities, conducting due diligence, and working with portfolio companies to improve operations and financials.

- Hedge Fund Management: Hedge fund managers make investment decisions for hedge funds, using a variety of strategies such as long and short positions, derivatives, and leverage. They are typically responsible for generating returns for their investors.

- Asset Management: Asset managers work for companies that manage investment portfolios on behalf of clients. They may specialize in areas such as mutual funds, exchange-traded funds, or alternative investments.

- Risk Management: Risk management professionals help organizations identify and manage potential risks. They may work in areas such as credit risk, market risk, or operational risk.

- Financial Analysis: Financial analysts provide research and analysis to help organizations make informed financial decisions. They may specialize in areas such as equity research, credit analysis, or mergers and acquisitions.

- Financial Planning: Financial planners help individuals and families with their long-term financial goals, such as retirement planning, education funding, and estate planning.

- Sales and Trading: Sales traders buy and sell securities on behalf of their clients, while trading traders buy and sell securities for their own account.

- Compliance: Compliance professionals ensure that organizations comply with laws and regulations related to securities, banking, and other financial services.

- Financial Technology: Financial technology, or fintech, professionals work in companies that use technology to make financial services more efficient and accessible, they may specialize in areas such as online lending, robo-advisory or mobile payments.

- Stock Exchanges: Stock exchange professionals work in organizations that facilitate the buying and selling of securities, they can work on different areas such as market operations, trading, regulation and compliance.

- Real Estate Investment Trusts (REITs): REITs professionals work in companies that own, operate, or finance income-producing real estate, they can work on areas such as property management, financing or portfolio management.

This is not an comprehensive list, there are many other opportunities available in the finance field, depending on one’s education, experience, and area of interest. Some jobs may require advanced degrees or certifications, while others are more entry-level.

Frequently Asked Questions

What is an example of a finance company?

For example, many people who purchase vehicles from General Motors obtain their loans from General Motors Acceptance Corporation (GMAC). The Ford Motor Company owns Ford Motor Credit Company (FMCC), and Daimler Chrysler owns a finance company called Daimler Chrysler Financial Services.

How many companies are in the financial sector?

As far as the number of companies in the financial services industry is concerned, there are over 530,000 private and over 1,000 government finance and insurance establishments that employ about 6.55 million people in the U.S. This is up from the 6.52 million people employed in 2021.

Which skill is best for finance?

7 Finance Skills That Will Have A Strong Impact On Your Career

- Accounting skills.

- Data management.

- Cash flow management.

- Mathematics.

- Business intelligence.

- Analytical thinking.

- Financial management.

What does a finance company do?

Accept deposits and repayable funds and make loans: Providers pay those who give them money, which they in turn lend or invest with the goal of making a profit on the difference between what they pay depositors and the amount they receive from borrowers.

What kind of job is financial services?

Financial services professionals work across multiple industries. You can find jobs in the insurance, securities or accounting fields. Job options include specialized areas, such as taxes; general, managerial or forensic accounting; and investments.

What is the highest qualification in finance?

Chartered Financial Analyst (CFA)

The Chartered Financial Analyst Institute regulates and awards the CFA qualification, which is the highest level of qualification in the investment management profession.

Final Words

The finance industry is a diverse and complex field that encompasses a wide range of companies and organizations. From banks and insurance companies to investment firms and credit rating agencies, each entity plays a critical role in the global economy.

Understanding the different companies and their functions within the finance industry is important for anyone looking to make informed financial decisions.

What a niche post! This is very important and useful information.

Thanks for the comment Jessica.