Which Banks Have The Best Mobile App and Online Banking in Nigeria?

Which Banks Have The Best Mobile App and Online Banking in Nigeria?

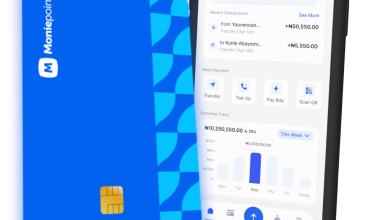

Best Mobile Banking Apps in Nigeria The use of mobile banking has become increasingly popular over the years as many banks in Nigeria compete to provide the best mobile apps to customers.

In this article, we will take a closer look at the best mobile banking app in Nigeria, its features, and the security measures in place to protect customers’ finances.

A mobile banking application is a digital platform that allows bank customers to access banking services through their mobile devices.

It is a convenient and simple way to perform banking activities such as checking account balances, transferring funds, paying bills, and applying for loans without going to the bank.

Through mobile banking applications, customers can easily access their bank accounts conveniently, anytime, anywhere.

What can you do with a mobile banking app?

Mobile banking applications provide a variety of services to customers. Some of the activities you can do with mobile banking include:

- Check account balance: With the mobile banking app, you can check your account balance at any time without needing to go to the bank.

- Money Transfer: You can transfer money between your accounts or to other bank accounts in Nigeria and abroad using the mobile banking app.

- Pay bills: You can pay for utilities such as electricity, water, cable TV, airtime, and internet services directly from your mobile device.

- Apply for a loan: You can apply for a loan on the mobile application and receive money directly into your bank account if your loan application is approved.

- ATM withdrawal without a card: You can withdraw money from an ATM without a debit card using the mobile banking app.

- Deposit a check: Some mobile banking apps allow customers to deposit checks without going to the bank. What security measures do banks use on mobile applications to ensure customers’ financial safety? Mobile banking apps are vulnerable to fraudulent activities such as phishing, identity theft, and malware attacks.

Banks are aware of this and have put in place measures to protect customers’ finances and personal information. Some of these measures include:

- Two-factor authentication: This requires using an additional authentication method, such as a token or one-time password, to verify transactions.

- Biometric verification: Banks use biometric authentication such as digital or facial recognition to verify customers’ identities before allowing access to their accounts.

- Encryption: Mobile banking apps use encryption to protect customer data and prevent unauthorized access.

- Fraud Monitoring: Banks monitor account activity to detect suspicious transactions and alert customers to potential fraudulent activity.

- Regular updates: Banks regularly update their mobile applications to fix vulnerabilities and provide new security features.

Which Banks Have The Best Mobile App and Online Banking in Nigeria

In this article, we will highlight the top eight mobile banking apps and online banking services in Nigeria.

- Zenith Bank Mobile App: Zenith Bank Mobile App gives you a seamless banking experience and makes banking transactions very easy. With the mobile app, you can transfer money, pay bills, buy airtime, check your account balance, and more. Its security features include facial recognition and fingerprint authorization.

- Access Bank Mobile App: Access Bank Mobile App is one of the few banking apps that does not offer any transaction fees. If you are an Access Bank account holder, you can transfer money, pay bills, check your account balance, and withdraw money from your ATMs without a card.The Access Bank mobile application has undergone several updates and can now be used without an internet connection.

- GTBank Mobile App: GTBank Mobile App is another top-performing banking app in Nigeria. It offers an impressive user interface and a wide range of banking services including fund transfers, bill payments, and airtime recharges.Additionally, the GTBank mobile app has advanced security features including facial recognition, fingerprint authorization, and security tokens.

- FirstMobile App: FirstMobile App is the mobile banking arm of First Bank Nigeria. It offers a user-friendly interface that is easy to navigate. The app provides a variety of services, such as bill payments, multiple transfers, quick airtime recharge, and account balance checks.Additionally, FirstMobile App is secured with a Personal Identification Number (PIN) and One Time Password (OTP).

- PiggyVest App: The PiggyVest App is an online savings and investment app.This is a powerful platform that allows you to save and invest your money in various businesses, such as stocks, treasury bills, and mutual funds. PiggyVest app comes with basic and main free plan features as well as a PRO version with more features.

- UnionMobile App: UnionMobile App is another banking app that provides secure and easy access to banking services.With the UnionMobile app, customers can pay bills, transfer money, check account balances, and buy airtime. The UnionMobile app is secured with biometric authentication and token assurance.

- EazyBanking App: EazyBanking App is the mobile banking app of Ecobank Nigeria. This app offers a variety of banking solutions like checking account balances, paying bills, transferring money, and applying for loans. The EazyBanking app offers fingerprint and facial verification as well as mobile security features.

- FCMB Mobile App: FCMB Mobile App is another great addition to the banking industry. It allows users to access a variety of banking solutions such as airtime top-ups, transfers, bill payments, and checking account balances. FCMB mobile app is secured and protected by token authentication and transaction confirmation.

FAQs: Which Banks Have The Best Mobile App and Online Banking in Nigeria?

1. What is the best bank mobile app in Nigeria?

Answer: There are many banks with great mobile apps in Nigeria, but some stand out. GTBank, Zenith Bank, First Bank, and Access Bank have been hailed by users as the top bank mobile apps in the country.

2. Which bank has the most secure online banking system in Nigeria?

Answer: Security is always a top priority when it comes to online banking. Many Nigerian banks have invested heavily in their cybersecurity measures, but some stand out. EcoBank is known for its high level of security and has one of the most trusted online banking systems in Nigeria.

3. Are there banks in Nigeria with mobile apps for both iOS and Android?

Answer: Yes, several banks in Nigeria have mobile apps for both iOS and Android. The leading banks that offer mobile apps on both platforms include GTBank, First Bank, Access Bank, and Zenith Bank.

4. What are some features to look out for when choosing a bank mobile app in Nigeria?

Answer: When selecting a mobile banking app in Nigeria, consider features such as ease of use, security, transaction limits, payment options, and customer support. Some bank apps even offer personal financial management tools to help you track your spending and savings goals.

Conclusion

In conclusion, Nigerian banks have continued to improve their mobile apps and online banking systems to make banking more convenient and seamless for their customers. GTBank, First Bank, Access Bank, and Zenith Bank have been recognized by users as the best mobile banking apps. Ensure to consider important features when selecting a bank app to ensure you get the best and most secure banking experience.