7 Steps to Become Financially Free And Live a Good Life

You want to become financially free. To never have to worry about money again. To travel the world in style. To live the quote on quote ‘good life.’ That’s the stuff of dreams. And it remains a dream for most people.

They have been conditioned by society to believe that having lots of money and enjoying themselves is only possible after decades of back-breaking work. When they are north of 65, retired, and greying. Why would you plan towards starting to enjoy life when it’s just about to end? I’ve never quite understood that. And It doesn’t have to be that way.

You can change this mindset and get started on creating a more prosperous life for yourself right now. Even if you just starting out. Even if you are as broke as a joke.

7 Steps to Become Financially Free And Live a Good Life

Here are ways you can make lots of money and become financially free without living like Scrooge and while still young.

1. Start with a plan

What it means to be financially free is as different from one person to the other as our faces are different. While you may only be satisfied with the latest Gulfstream jet and your own private island, some people are just content with living comfortably and debt-free. To create the kind of life you want, you must define what precisely financial independence means to you.

Be as specific as possible -outline your bank balance you’ll like to have, the lifestyle, and the timeline at which you’ll get them. Then carry out an audit of your actual financial position now – be realistic and factual. This will help you to create a long-term goal and determine the work you have to do to cover the gap between your current situation and your end goal.

Lastly, create smaller goals and milestones at regular intervals to help you work steadily towards your desired goal.

2. Stop exchanging time for money

To make lots of money in a relatively short period, the traditional 50-hour of working for a steady paycheck may not cut it. Not that you can’t get rich by working a 9 -5, but most financially successful people do not trade their time for money.

You might work very hard 50 hours a week and even sacrifice your weekends, and maybe, just maybe, the boss may like you and give you a raise. And you slave away for several more years till you retire and live off the money you managed to save up. The problem with this model is that your income is limited – by time.

We all have 24 hours in a day, and most of that time will be taken up by other existential activities leaving you with only about 10 hours to trade for income. The truth is that time is the most essential commodity in the world because it’s limited. So if you exchange time for money, your income will always be limited.

But how do you stop trading this most valuable of all resources and create time for the things that matter most? Start with a change in mindset: you must think of trading value for money rather than time. What skills, knowledge, talents do you have that people value? When your thinking shifts, it opens up your mind to the endless opportunities out there – money.. is.. everywhere.

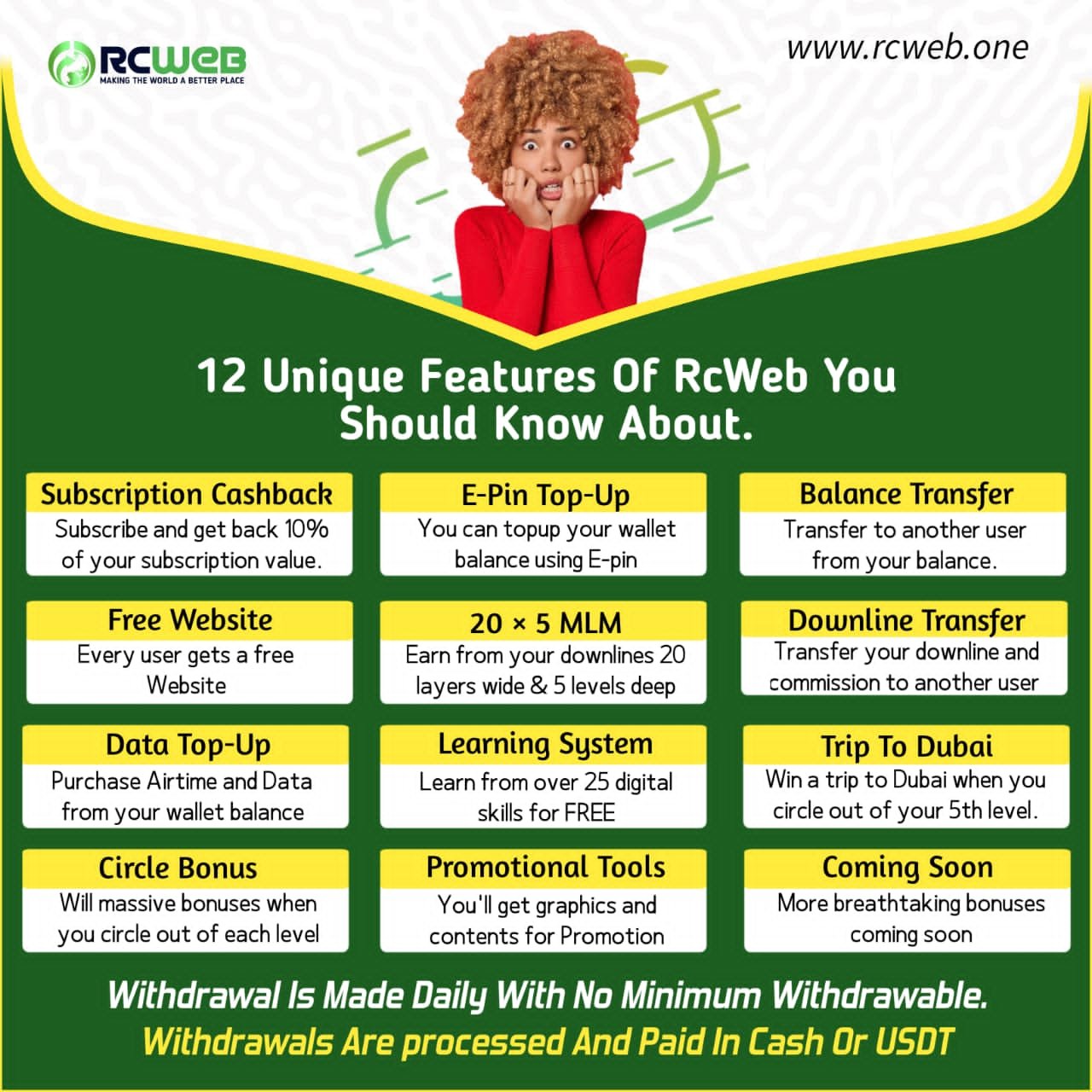

When you discover what it is that you can do better than most- not that you have to be the best, find a way to create value for others, and shamelessly promote yourself. There are several ways you can put your unique skills to use making money for you. You can sell your services as a freelancer, where you freely determine how much you earn and choose who you work with. Or position yourself as an authority in your particular niche, create and sell a product, for example; – an eBook, a blog, training course, or consultancy services.

The best part? You can automate most of the processes, leaving you enough time to be sipping margaritas at an exotic beach. At the same time, your earnings continue to come in. And since you don’t have to spend all your time selling, you can start up other lines of passive income and grow your money faster.

3. Invest in yourself

To be a person of value, you must place a premium on your personal and professional growth. This is about the most profitable investment you can make. It gives you compounded returns over time and increases your worth in the present.

Seek to improve yourself every day – drop habits that do not align with your goals and pick up new, more productive habits. Invest in courses and training to increase your skills and knowledge. So you’ll be better equipped to negotiate a raise if you are employed and raise your fees if you work for yourself. Self-improvement should also extend to your health.

Ensure to eat healthily, sleep optimally, and exercise your body. You can’t indeed be wealthy if you’re in poor health. Investing in yourself to achieve higher productivity, make more money, and live a better quality of life. It not only shapes your interaction with the outside world but also determines how you feel about yourself.

4. Live beneath your means

Although much cliched, living below your means is the thread that holds every aspect of your personal finance together. Without it, financial freedom is impossible. It’s like driving a car with the wheels off -you won’t be going anywhere.

Unfortunately, this is one aspect most people struggle with – burdened with credit card debts. Learning this is so important because you’ll need to free up cash to use for wealth creation. If you haven’t already mastered this age-old skill, it might be one of the most challenging steps you’ll have to make. It will entail making painful changes in your lifestyle and forgoing untamed spending, which you have become accustomed to.

At the root of the problems lies the human need for instant gratification. And the solution is to think long term. ‘Sacrifice’ needless expenses for a better financial future.

Become comfortable with delayed gratification, and learn to avoid triggers that make you open up your wallets like a water hydrant. Cut unnecessary expenses from your budget. In time, you’ll gladly see that you have an emergency fund, increased your savings, reduced or eliminated your debt, and have enough to invest.

5. Learn to manage money

Managing your money is about accounting for every dime that goes in or out of your accounts. Create a detailed budget to help you keep track of expenses, ensure your bills are paid timely, and your saving goals are met. It also helps you to curb impulse spending and avoid costs that are not provided for in the budget.

A budget won’t be of much help to you if you don’t stick to it religiously. And one of the best ways to do this and understand your finances better is by tracking every penny that leaves your pocket. It doesn’t have to be complicated or time-consuming.bSome apps let you automate it.

When you analyze your expenses report for the month, you’ll be surprised to find out you spend more money than you assumed on certain items. You can clearly see where your money goes and the unnecessary costs that you should excise. Managing your money is much easier when you simplify your finances.

Streamlining your accounts, bills, credit cards, debts, etc. makes it easier to stay on top of your money and help you keep more of it. Rather than having several accounts scattered all over the place, consolidate them to just a checking account and a savings account with one or two banks. With your account in one place, you’ll reduce paperwork, negotiate lower fees, and have an overview of your account with a single sign on to the online banking platform. No need to log in to each account separately.

Also, consolidate your loans as much as possible. Its much easier keeping track of one repayment than having to track several loans and probably end up paying late fees. When you have simplified your finances by paring down your accounts, you can use technology to further make it easier for you to manage.

Several apps are available that can automate tasks like savings, investing, paying bills, and more. Automation will save you time which you can dedicate to a higher return on investment (R.O.I) tasks like analyzing your finances. Plus, zero worries about missing a due bill payment.

6. Save and Invest

Save money no matter your situation. Most people make the mistake of assuring themselves they’ll start saving when their income increases. But that time never comes. And when life throws an unexpected curveball- as it always does, they flounder and fail.

If you cant make room in your budget for some savings, find ways to increase your income or reduce your expenses or even better, do both. Just save money. This is absolutely fundamental.

When you have saved up to 6 months or more of living expenses in an emergency fund, it’s time to start investing. Financial freedom is achieved faster when you put your money to work for you. Of course, there are better times to invest than others. But since you are no seer, it’s better to always invest no matter what the market is doing.

You can minimize your risk by dollar-cost averaging into the stock market. Also, diversify your investments across different assets to protect yourself from unexpected surprises. Your portfolio should comprise of stocks, P2P lending, cash, fixed-income investments, and real estate. In the event of a black swan event which affects any one of the sectors, you won’t take a big hit.

7. Avoid debt – unless it makes you more money.

You can’t become financially free when you still owe banks or other people. Plan towards getting out of debt as quickly as possible. Start with changing the habits that got you into debt in the first place.

Pay off credit cards and similar high-interest consumer loans first. Then gradually work down mortgages and students’ loans – which typically have lower interests. And once you eliminate debt in a category, never come back.

You won’t become debt-free overnight, but the earlier you start attacking them, the faster you approach financial independence. So in conclusion. There are no get-rich-quick schemes for building wealth. To become financially free with enough money to play around, you must put in the work and discipline required.

In Conclusion

Putting these 7 tips into practice, and making a habit out of them will accelerate your growth financially and set you up for a great future.

So in summary: 1. Start with a plan. 2. Stop exchanging time for money. 3. Invest in yourself. 4. Live beneath your means. 5. Learn to manage money. 6. Save and invest. 7. Avoid debt unless it makes you money.

Thank you so much for reading, if you found value in today’s content give it a positive comment. With that said, I will see you in the next one.

One Comment