List of Loan Apps That Call Contacts and Send Messages to Contact.

List of Loan Apps That Call Contacts and Send Messages to Contact.

Loan apps in Nigeria request access to borrowers’ phone contact lists for a few reasons:

- Marketing and Referral Programs: Loan apps use this feature to promote their services to the borrower’s contacts. They offer incentives, such as discounts or cashback, to both the borrower and the referred contact if they sign up and borrow money.

- Creditworthiness: Some loan apps use the contacts list to verify the borrower’s creditworthiness. They check if the borrower has any connections with people who have a good credit history or are financially stable. This helps them assess the borrower’s ability to repay the loan.

- Debt Collection: Loan apps may use the contacts list to contact the borrower’s friends or family members in case of loan default. They believe that these individuals may be able to help them recover the loan amount.

- Fraud Prevention: Loan apps also use this feature to prevent fraudulent activities. They check if the borrower’s contacts have similar details, such as name, address, or phone number, as the borrower’s. If they find any discrepancies, they may suspect fraud and deny the loan request.

However, some people consider this feature as an invasion of privacy, and there have been reports of loan apps sharing contacts without consent or using them for unwanted marketing purposes. As a result, some regulators in Nigeria have warned loan apps against misusing this feature and have advised borrowers to be cautious while sharing their contacts list with loan apps.

List of Loan Apps That Call Contacts and Send Messages to Contact.

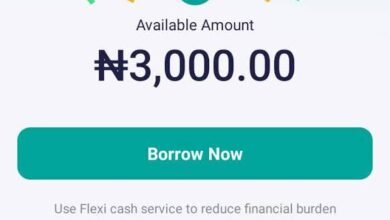

Loans have become an essential part of many people’s lives. With the rise of technology, loan apps have gained immense popularity due to their convenience and accessibility. However, there have been concerns regarding certain loan apps in Nigeria that use dubious methods to collect loan repayments.

ICoin

ICoin is a loan app in Nigeria that offers quick cash loans to individuals in need. However, some borrowers have reported instances where the app continuously calls and sends messages as a form of harassment when they are unable to repay their loans. This aggressive approach can be distressing for borrowers and raises concerns about the ethical practices of such loan apps.

Sokoloan

Sokoloan is another loan app that operates in Nigeria. While it claims to offer seamless borrowing experiences, there have been allegations that Sokoloan resorts to harassment tactics when borrowers default on their repayments. Calls and messages demanding immediate payment can create stress for individuals already facing financial difficulties.

LionCash

LionCash, a popular loan app in Nigeria, is known for its easy and quick loan processes. However, some borrowers have expressed dissatisfaction with the app’s approach to loan recovery. Rather than employing fair and respectful methods, LionCash has been accused of resorting to harassment tactics, including continuous phone calls and intrusive messages.

CashLion

CashLion is a loan app that promises instant loans to Nigerians. While the app seems attractive at first glance, borrowers have reported instances of unwarranted calls and messages that border on harassment. This aggressive behavior can add to the financial burden and mental stress of borrowers who are already struggling to repay their loans.

Okash

Okash is a well-known loan app that prides itself on its quick and hassle-free loan approval process. However, some borrowers have had negative experiences with the app’s collection methods. Instead of understanding the financial difficulties of borrowers, Okash has been accused of resorting to relentless calling and messaging, creating a hostile environment for those already struggling financially.

EasyCredit

EasyCredit is a loan app that provides instant loans to Nigerians in need. While it aims to make loans accessible to all, there have been instances where borrowers feel harassed by the app’s collection practices. With repeated calls and messages, EasyCredit puts additional pressure on individuals who are unable to repay their loans promptly.

Oxloan

Oxloan is a loan app that offers fast cash loans with minimal requirements. However, reports of harassment tactics have tarnished its reputation. Borrowers have complained about the persistent calls and messages from Oxloan, even when they have expressed their inability to repay the loan due to unforeseen circumstances.

Ease Cash

Ease Cash is another loan app in Nigeria that claims to offer hassle-free loans. However, several borrowers have accused the app of using harassment techniques to collect repayments. With constant calls and messages that border on intrusion, Ease Cash creates an uncomfortable and stressful situation for borrowers in financial distress.

FastMoney

FastMoney is a loan app that promises quick loans with no collateral. While the app offers convenience, some borrowers have encountered issues with its debt collection methods. Persistent calls and messages that disregard the financial challenges faced by borrowers contribute to an atmosphere of harassment and anxiety.

GetCash

GetCash is a loan app that caters to the urgent financial needs of Nigerians. Despite its aim to provide timely assistance, some borrowers have raised concerns about the app’s aggressive tactics when it comes to loan recovery. With continuous calls and messages that feel like harassment, GetCash fails to exhibit empathy toward individuals facing financial difficulties.

Other loan apps That Call Contacts and Send Messages to Contact

9ja Cash

Softpay

Rapid Naira

Monicredit

Ucredit

LCredit

Xcredit

PalmCredit

ForNaira

GoCash

Cashrain

KashKash

9credit

Alternatives to Loan Apps That Invade Privacy

If you are concerned about loan apps that invade privacy by calling contacts and sending messages, there are several alternatives you can consider. Here are a few options to explore:

- Traditional Banks or Credit Unions

Consider approaching traditional banks or credit unions for loans. These financial institutions typically prioritize customer privacy and have rigorous security measures in place. Although the loan approval process may take longer compared to loan apps, you can rest assured that your personal information will be secure.

- Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms connect borrowers with individual lenders, cutting out the need for intermediaries like loan apps. These platforms offer competitive interest rates and provide transparency regarding their data security practices. By opting for peer-to-peer lending, you can access loans while maintaining control over your personal information.

- Loans from Friends and Family

When in need of financial assistance, consider reaching out to friends or family members who may be willing to offer loans. This option ensures complete privacy and eliminates the risk of your contacts being contacted or messaged by loan apps. However, make sure to maintain clear communication and establish repayment terms to avoid straining personal relationships.

FAQs

What are Loan Apps That Call Contacts and Send Messages to Contacts?

Loan apps that call contacts and send messages to contacts are applications available on smartphones that offer quick and easy access to loans. However, they come with a downside, as they often access users’ contact lists and send messages or make calls to these contacts without the user’s knowledge or consent. This invasion of privacy raises concerns about data security and personal information protection.

Why do Loan Apps Require Access to My Contacts?

Loan apps often ask for access to your contacts to expand their customer base and increase their reach. By accessing your contact list, these apps can identify potential borrowers within your network and send them promotional messages or make direct contact. However, it is important to note that not all loan apps engage in these practices. Some reputable apps prioritize user privacy and do not call or message your contacts.

Is it Safe to Use Loan Apps That Call Contacts and Send Messages to Contacts?

Using loan apps that call contacts and send messages to contacts poses potential risks to your privacy and personal information. These apps may misuse your contacts’ data, leading to unsolicited messages or calls to your friends, family, or colleagues. Additionally, granting access to your contact list can compromise the security of your contacts’ information. It is crucial to thoroughly research and choose reputable loan apps that prioritize data security and respect user privacy.

Conclusion

While loan apps have revolutionized the lending industry, it is crucial to ensure that borrowers are treated with respect and dignity. Harassment tactics employed by certain loan apps, including ICoin, Sokoloan, LionCash, CashLion, Okash, EasyCredit, Oxloan, Ease Cash, 9ja Cash

Softpay, Rapid Naira, Monicredit, Ucredit, LCredit, Xcredit, PalmCredit, ForNaira, GoCash, Cashrain, KashKash, 9credi, tFastMoney, and GetCash, go against ethical practices. Regulators need to address this issue and ensure that borrowers are protected from harassment in the loan recovery process. As borrowers, it is crucial to research and choose loan apps that prioritize fair and respectful practices to avoid unnecessary distress and anxiety.