Kuda is the first digital-only bank to operate in Nigeria. It was founded and launched in 2019 by two tech gurus, Babs Ogundeyi and Musty Must, to provide users with banking services through digital-savvy millennials and young professionals. Kuda differs from traditional banks because it offers only a mobile-centric banking experience, which permits users to conduct all their banking activities through their mobile home.

One of the features of Kuda is its ease of account creation. Unlike the traditional bank, that would require a tedious process before opening an account. With Kuda, customers can create their accounts with their smartphones within minutes. This quick and hassle-free Kuda onboarding process has attracted many young Nigerians who seek more convenience and Digital ways of carrying out their transactions.

Like most other digital banking Fintech, Kuda offers several banking services, including free debit card issuance, savings feature, transfer, receive funds, bill payments, and budgeting tools. With the Kuda app, customers can easily control their finances, track expenses, and set their saving goals. Kuda’s simple and user-friendly design makes it more convenient for customers to navigate and access the necessary services.

Kuda has gained popularity in Nigeria as a digital banking alternative that offers convenience, affordability, and a seamless user experience. Its focus on the needs of the digital-native generation positions it well to capture a significant share of Nigeria’s growing fintech market.

On the other hand, Palmpay is not a digital bank like Kuda. Still, it is a payment platform launched in 2019 to provide a comprehensive digital payment suite that caters to their user’s financial needs, such as payments, transfers, bill payments, and more. Palmpay is functional in Nigeria and a few other African countries. The Fintech company is owned by Transsnet Financial, a joint venture between Chinese -owned Transsion Holding and NetEase, a Chinese internet company.

One reason why many users accept Palmpay is its partnership with various merchants and service providers. Customers can make payments and also receive discounts at Palmpay partner outlets, including restaurants, supermarkets, and online stores. This incentivizes users to continue using Palmpay for their day-to-day financial transaction needs, which will inversely promote cashless transactions.

With Palmpay users can use its peer-to-peer money transfer feature, which allows users to send and receive money instantly. This feature benefits users who want to send me to their family, friends, or business partners quickly and efficiently. Additional users can make bill payments, recharge card top-ups, and purchase internet data directly using their Palmpay app.

To encourage palmpay adoption, the Fintech company introduced a reward program and Cashback incentives. This means that users receive cash back and points on every transaction, which can be redeemed for discounts or used for future purchases within the Palmpay ecosystem. This reward strategy aims to encourage users to carry out more transactions and build customer loyalty.

Table Comparing Kuda and Palmpay across major features

| Features | Palmpay | Kuda |

| Total Downloads | 5M + | 5M + |

| App store ratings | 4.5 (334k+) reviews | 4.0 (184k) reviews |

| POS machine | Yes. Available | Yes. Available |

| Debit cards | No | Yes. Available |

| Free transfer | 10 free transfer | 25 free transfer |

| Cashback Incentive | Yes | No |

| Discount | Yes | No |

Comparison of Features and Benefits of Kuda and Palmpay.

Kuda and Palmpay are two popular digital banking platforms in Nigeria that offer various financial services. Kuda focuses more on traditional banking services like saving and lending, while Palmpay is geared towards convenience and affordability with its cash back rewards and discounts. Ultimately, choosing which platform to use depends on individual preferences and needs. Below is a comparison of their features and benefits.

Features:

- Kuda: Offers free ATM withdrawals, debit card issuance, and savings accounts with up to 15% annual interest rate.

- Palmpay: Offers bill payments, airtime top-up, fund transfer, and virtual card issuance.

Benefits:

- Kuda: Unique features like 24/7 customer support, automated savings, and budgeting tools.

- Palmpay: Offers cashback rewards, discounts, and promo codes on transactions made on the app.

User Experience and Interface of Kuda and Palmpay

Kuda and Palmpay interface is designed to be user-friendly with simple navigation and helpful features. Users efficiently use both apps to perform transactions and take advantage of the convenience, and reward it offer.

User experience is the overall feeling and satisfaction of users when interacting with the application. In contrast, user interface is the visual and functional aspect of the application that facilitates user interaction. Here are some elements of user experience and user interface in Kuda and Palmpay applications.

Kuda:

User Experience:

- Simple and straightforward account opening process.

- All account information is displayed on the home screen, making it easy to view and manage.

- The “Goals” feature helps users save money towards a specific target.

- The “You and Kuda” feature shows users how to use the app through an interactive guide.

User Interface:

- Clean and modern design with a blue and white color scheme.

- The bottom tab bar provides easy navigation to different sections.

- Simple and clear icons and labels make it easy to understand using different features.

- The notification center alerts users of any updates or activities within their account.

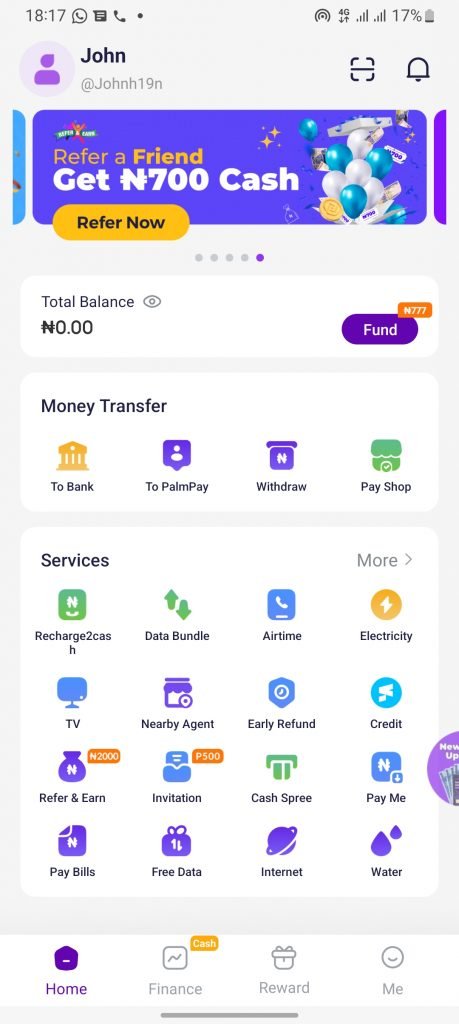

Palmpay:

User Experience:

- Quick and easy sign-up process with email address or phone number.

- Offers users cashback rewards for using the app to make payments.

- The “Points” feature allows users to redeem reward points for vouchers and discounts.

- Users can purchase airtime and data directly from the app.

User Interface:

- A white background with green and yellow accents creates a fresh and vibrant look.

- The home screen provides easy access to different sections, such as payments, rewards, and account settings.

- The “Quick Access” feature shows recently used features.

- The presence of chat support allows users to get assistance when needed.

Security and Risk Management of Kuda and Palmpay

Security and risk management are crucial aspects of fintech companies like Kuda and Palmpay. Both companies must ensure the safety and protection of their customers’ personal and financial information, as well as manage potential risks that may arise in their operations.

Here are some key considerations for the security and risk management of Kuda and Palmpay:

- Data Security: Both Kuda and Palmpay need to implement robust security measures to protect customer data from unauthorized access, breaches, or leaks. They should use encryption and other relevant security technologies to safeguard sensitive information.

- Compliance with Regulatory Standards: Fintech companies must comply with relevant regulations and laws to ensure legal and secure operations. Kuda and Palmpay should establish effective processes and controls to meet the requirements set forth by financial regulatory bodies.

- Fraud Prevention: Implementing strong fraud prevention measures is essential for both companies. This may include real-time monitoring of transactions, user authentication, and fraud detection systems. They should continuously update their systems to stay ahead of evolving fraud techniques.

- Internal Security Controls: Kuda and Palmpay should have robust internal security controls to protect against internal threats. This involves conducting background checks on employees, implementing access controls, and ensuring employees are trained in security best practices.

- Third-Party Risk: Both companies may rely on third-party vendors for various services. They should conduct thorough due diligence on these vendors to assess their security and risk management practices. Regular audits and assessments are necessary to monitor the security posture of these vendors.

kuda and Palmpay Customer Support Comparison

Before making your choice on the payment platform to use, it is very important to look at their customer service support. This is because those are people you contact when things go wrong with your account. Below are the ways you can contact Kuda and Palmpay customer service.

Kuda offers customer support via in-app chat, email, and phone. They have a 24/7 customer service team that is said to be responsive and helpful. Users can also access a comprehensive FAQ section on Kuda’s website.

Palmpay provides customer support via in-app chat, email, social media, and phone. They also offer a self-help option through an extensive help center on their website.

In terms of comparison, both Kuda and Palmpay seem to have similar options for customer support, including in-app chat and email support. Kuda’s 24/7 customer service team may be a differentiating factor, as it offers users access to assistance at any time. However, Palmpay’s extensive help center may provide more comprehensive information for users seeking self-help options. Ultimately, the quality of customer support will depend on individual experiences and needs.

Fees and Charges of Kuda and Palmpay

Kuda provides users with 25 free transfers per month after which they charge N10 per transaction.

Palmpay offers users 10 free transfers per month after which they charge N10 per successful transfer.

Pros and Cons of Kuda and Palmpay

These are the pros and cons of both Kuda and Palmpay. It will help you further to make an informed choice between Kuta and Palmpay.

Kuda Pros:

- No maintenance or ATM withdrawal fees

- Free debit card

- Provides interest on savings account

- Offers several budgeting and account management tools

- Good customer service

Kuda Cons:

- Only available in Nigeria

- Limited features compared to traditional banks

- No physical branches

Palmpay Pros:

- Offers a cashback reward system

- Provides a QR code payment option

- Offers insurance and investment options

- Provides airtime top-up services

Palmpay Cons:

- Limited customer service

- Limited to only a few African countries

- High transfer fees compared to other payment apps

- Some users report issues with the app’s usability and security.

Frequently Ask Questions (FAQs)

Do I need a BVN To Create Kuda and Palmpay account?

Yes. BVN is needed to complete your verification and upgrade your account to receive bigger money in your account. It is also mandatory to link your BVN to your accounts.

Kuda and Palmpay: which is better ?

Well it all depends on what you want, for Kuda it’s give you more of trade banking services while palmpay offers more services.

Can I obtain a loan from Kuda or Palmpay?

Yes. You can get low interest loans from either palmpay or Kuda. However according to a report online palmpay loan agents can harass it’s loan defaulters.

Conclusion: Kuda and Palmpay Which is better for you?

We cannot give a straightforward answer to this question. This is because a lot of things come into play when you try to determine the one that is better. The first is that it is your personal preferences, needs, and situation that determine the one you can use. we recommend that you do research on both Kuda and Palmpay to determine which one fits your requirements and needs. You can consider the features, benefits, limitations, fees, ease of use, customer support, and reviews from other users before making your decision.