Instant Loan in Nigeria – Which App Gives Loan Immediately in Nigeria?

Instant Loan in Nigeria - Which App Gives Loan Immediately in Nigeria?

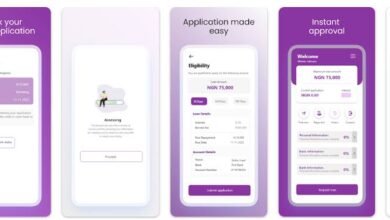

In Nigeria, utilizing a loan app can be very beneficial if you require an immediate loan. These cutting-edge smartphone apps have completely changed the lending landscape by giving people a quick, easy, and hassle-free way to apply for loans. We’ll examine what a loan application is in this post, along with the benefits of using one for a speedy loan and the significance of obtaining one.

What’s a loan application?

A loan application is a smartphone application that enables consumers to apply for and obtain loans. These applications replace the need for conventional paperwork and drawn-out approval procedures by streamlining the loan application process through the use of technology and digital platforms. You can access funds that meet your financial needs with a few taps on your phone.

Why is the loan App regarded as a good choice for fast loans?

The loan application has several benefits over traditional lenders in terms of quick loans. Initially, it offers a simple and easy way to apply for a loan at any time, any place, without physically going to a bank or other lending establishment. Furthermore, the requirements for qualifying for a loan have been streamlined, which has made it simpler for those with poor credit or little income to be approved for a loan. Another significant benefit is the speed at which loans are approved and disbursed. This is so that you can quickly access your money as it will be transferred to your bank account in a matter of minutes

Instant Loan in Nigeria – Which App Gives Loan Immediately in Nigeria

Is your unexpected financial emergency requiring immediate cash? With more loan apps becoming available in Nigeria, obtaining a loan has never been simpler. We’ve put together a list of the top 12 instant loan apps in Nigeria to assist you in making an informed choice.

- Carbon (Formerly Pay later): One of the most widely used loan applications in Nigeria was once called Paylater. You can download the app for iOS and Android smartphones. You can get approved for a loan in a matter of minutes after completing the simple application process. Additionally, the loan disbursal is quick; you should receive the money in your account in less than a day. Depending on the type of loan you select, the interest rate can range from 5% to 15%, and the repayment schedule is flexible.

- BranchBranch: Another loan app that has grown in popularity in Nigeria is BranchBranch. You can download the app for iOS and Android smartphones. You can get approved for a loan in a matter of minutes by following the easy and clear loan application process. Additionally, the loan disbursal is quick; you should receive the money in your account in less than a day. The repayment plan is flexible, and the interest rate fluctuates between 15 and 34%

- FairMoney: Quick loans are available to Nigerians through the FairMoney loan app. You can download the app for iOS and Android smartphones. You can apply for a loan with ease and receive approval in a matter of minutes. The money is typically credited to your account quickly after the loan is disbursed.

- Credits Aella: Aella Credit is a lending App that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Loan payments are also fast, with the money usually deposited into your account within 24 hours. Interest rates range from 4% to 29% and repayment schedules are flexible.

- Kiakia: Kiakia is a lending App that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Credit disbursements are also fast, with money usually deposited into your account within 24 hours. Interest rates range from 5.6% to 24% and repayment schedules are flexible.

- KwikCash: KwikCash is a lending program that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Credit disbursements are also fast, with money usually deposited into your account within 24 hours. Interest rates vary by loan product and repayment schedules are flexible.

- QuickCheck: QuickCheck is a lending program that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Credit disbursements are also fast, with money usually deposited into your account within 24 hours. The interest rate ranges from 10% to 35% and the repayment schedule is flexible.

- RenMoney: RenMoney is a lending program that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Credit disbursements are also fast, with money usually deposited into your account within 24 hours. Interest rates range from 4% to 4.5% and repayment schedules are flexible.

- PalmCredit: PalmCredit is a lending program that provides quick loans to Nigerians. You can download the app for Android and iOS devices. The loan application process is simple and you can be approved in minutes. Loan payments are also fast, with money usually deposited into your account within 24 hours. Interest rates range from 14% to 24% and repayment schedules are flexible.

- Specta

Specta is a loan app that provides quick loans to Nigerians. The app is available for download on both Android and iOS devices. The loan application process is simple, and you can get approved within minutes. The loan disbursal is also fast, with funds usually credited to your account within 24 hours. The interest rate ranges from 3% to 28%, and the repayment schedule is flexible.

- SnapCredit

SnapCredit is a loan app that offers fast loans to Nigerians. The app is available for download on both Android and iOS devices. The loan application process is easy, and you can get approved within minutes. The loan disbursal is also fast, with funds usually credited to your account within 24 hours. The interest rate varies between 26% – 30%, and the repayment schedule is flexible.

- QuickCredit

QuickCredit is a loan app that provides quick loans to Nigerians. The app is available for download on both Android and iOS devices. The loan application process is simple, and you can get approved within minutes. The loan disbursal is also fast, with funds usually credited to your account within 24 hours. The interest rate ranges from 1.75% to 5%, and the repayment schedule is flexible.

FAQs: Instant Loan in Nigeria – Which App Gives Loan Immediately in Nigeria?

Which loan app in Nigeria provides instant loans?

The FairMoney app is a loan app in Nigeria that provides instant loans.

How quickly can I receive a loan from the FairMoney app?

Once your application is approved, you can receive a loan instantly with the FairMoney app.

Is it safe to borrow loans from the FairMoney app in Nigeria?

Yes, it is safe to borrow loans from the FairMoney app in Nigeria as the app implements strict security measures to safeguard your personal and financial information.

Conclusion

In conclusion, the FairMoney app is a dependable option for those seeking an instant loan in Nigeria. With its fast and secure approval process, you can access the funds you need effortlessly. So, download the app today and experience the benefits of instant loans in Nigeria.