Best Loan App in Nigeria with Low Interest Rate 2024.

Best Loan App in Nigeria with Low Interest Rate 2024.

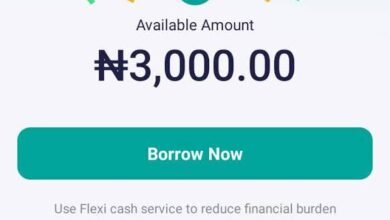

As some people say, “money makes the world go round,” and it is undoubtedly true. However, it can be quite challenging to get a loan in Nigeria, especially with low interest rates. We have compiled a list of the 15 best loan apps in Nigeria that offer low interest rates. These apps provide an easy and convenient way to secure loans without the stress of traditional banking processes. Whether you need funds for personal expenses, business growth, or emergencies, these loan apps can help you address your financial needs promptly. Let’s dive into the details of each app and explore their unique features.

1. KwikCash

KwikCash is a popular loan app in Nigeria that allows users to access loans up to ₦500,000 with an interest rate of 10%, with a 14 to 30-day repayment plan. The app provides a simple user interface, making it easy to apply and receive funds quickly. With flexible repayment options, KwikCash ensures that borrowers can comfortably repay their loans without burden.

2. Palmcredit

Palmcredit is another reliable loan app that offers instant loans with an interest rate of 10-30%. The repayment plan is between 30 to 180 days. in Nigeria. With Palmcredit, users can access loans up to ₦100,000 without collateral. The app provides a transparent and straightforward process, ensuring quick approval and disbursement of funds.

3. Carbon (formerly Paylater)

Carbon, formerly known as Paylater, is a well-established loan app in Nigeria. It offers loans up to ₦500,000 with an interest rate of 15-20%, and the loan repayment schedule is between 1 to 6 months. Carbon’s user-friendly interface and efficient loan disbursal process make it a go-to choice for many borrowers. Additionally, Carbon provides financial management tools and services to help users improve their financial well-being.

4. Branch

Branch is a loan app that provides loans of up to ₦200,000 with an interest rate of 12-30%. The repayment plan is between 7 to 180 days. The app focuses on financial inclusion and aims to empower individuals with access to credit. The branch also offers a referral program, allowing users to earn extra income by referring friends and family to the app.

5. FairMoney

FairMoney is a reliable loan app that offers loans up to ₦150,000 with an interest rate of 10-30%. The repayment plan is between 61 to 180 days. The app leverages advanced algorithms to determine a borrower’s creditworthiness, making the loan application process swift and seamless. FairMoney also provides an opportunity for users to build their credit scores and access higher loan amounts in the future.

6. QuickCheck

QuickCheck is a loan app in Nigeria that provides loans up to ₦200,000 with an interest rate of 10-30%. The repayment plan is between 14 to 180 days. The app utilizes artificial intelligence and machine learning algorithms to evaluate loan applications promptly. With QuickCheck, users can get funds deposited directly into their bank accounts within minutes.

7. Renmoney

Renmoney is a trusted loan app in Nigeria that offers loans up to ₦6,000,000 at an interest rate of 12 -28%. The app caters to both individuals and businesses, providing customized loan solutions tailored to specific needs. Renmoney also offers flexible repayment options to ease the burden on borrowers.

8. Aella Credit

Aella Credit is a loan app that provides loans up to ₦1,500,000 with an interest rate of 20-27%. The repayment schedule ranges from four weeks to six months.

The app focuses on helping individuals meet their financial goals by offering affordable and accessible credit. Aella Credit also offers financial management tools and resources to empower users to manage their finances effectively.

9. Palmcredit Plus

Palmcredit Plus is an upgraded version of Palmcredit, offering higher loan amounts of up to ₦200,000 with an interest rate of 14-24%. The app provides personalized loan offers based on a user’s creditworthiness. With its user-friendly interface, Palmcredit Plus ensures a seamless borrowing experience.

10. Kiakia

Kiakia is a loan app that offers loans up to ₦200,000 with low interest rates. The app provides quick loan disbursement and flexible repayment options. Kiakia utilizes advanced technology to make the loan application process hassle-free for borrowers.

11. Okash

Okash is a loan app in Nigeria that offers loans up to ₦50,000 with an interest rate of 10-28%. The app provides a convenient way to access quick funds for various purposes. Okash ensures a user-friendly experience, allowing borrowers to apply for loans and receive funds within minutes.

12. PayConnect

PayConnect is a loan app that provides loans up to ₦500,000 with an interest rate of 12-28%. The app offers flexible repayment options and aims to create financial empowerment for individuals. PayConnect also provides financial education and resources to help users make informed financial decisions.

13. Sokoloan

Sokoloan is a popular loan app in Nigeria that offers loans up to ₦100,000 with an interest rate of 10 -28%. The app ensures a seamless borrowing process, with quick approval and disbursement of funds. Sokoloan also rewards users with higher loan limits for timely repayment.

14. FairMoney Plus

FairMoney Plus is an upgraded version of FairMoney, providing higher loan amounts of up to ₦500,000 with an interest rate of 10%, with a 14 to 30-day repayment plan. The app utilizes advanced credit assessment techniques to determine loan eligibility and offers personalized loan options to borrowers.

15. GroFin

GroFin is a loan app that focuses on providing loans for small and medium-sized enterprises (SMEs) in Nigeria. The app offers customized loan solutions tailored to the unique needs of businesses. GroFin aims to support the growth and development of SMEs by offering low-interest-rate loans and business advisory services.

FAQs: Best Loan App in Nigeria with Low Interest Rate 2023.

1. What are some of the best loan apps in Nigeria that offer low-interest rates in 2023?

Several loan apps in Nigeria offer low interest rates to suit the different needs of borrowers. Some of the best loan apps are Carbon, Renmoney, FairMoney, and PalmCredit.

2. Which loan app in Nigeria offers the lowest interest rate in 2023?

Carbon currently offers the lowest interest rate in Nigeria in 2023, starting from 5% its low low-interest rate makes Carbon the ideal loan app for borrowers who want to save on interest payments.

3. What are the requirements to access loans on these loan apps with low-interest rates in Nigeria?

The requirements for accessing loans on loan apps vary depending on the app. However, some of the common requirements include a valid means of identification, proof of income, and an active bank account. Additionally, borrowers are expected to have a good credit score, a good repayment history, and meet the other criteria set by the loan app.

4. How can I get started with getting a loan on low-interest rate loan apps in Nigeria?

To get started with loan apps that offer low interest rates in Nigeria, you will need to download the loan app from the app store. After downloading, create an account, and provide all the necessary information. Once your application is approved, you can access loans instantly, subject to the terms and conditions of the loan app.

Conclusion

When it comes to obtaining quick funds in Nigeria, these 15 loan apps with low interest rates are reliable choices. Whether you need funds for personal expenses, business growth, or emergencies, these apps offer a seamless borrowing experience with flexible repayment options. Explore each app’s unique features and choose the one that aligns with your financial goals. Take control of your finances and meet your needs promptly with these trusted loan apps in Nigeria.