Top 10 App Similar To Opay – Opay Alternatives

Top 10 Fintech Payment, Microfinance Banks and Loan Apps Similar to Opay

Opay is a digital payment platform or E-wallet that has played a crucial role in repositioning Africa’s financial sector. Yahui Zhou, Chief executive officer of Opera, owns Opay. Users can perform several financial tasks using the Opay app on their smartphones. Opay is used to make payments, transfer funds, withdrawals, bill payments, Food delivery, and ride hire. Opay offers a secure and convenient way of carrying out financial transactions. Opay also makes use of sophisticated security protocols to secure the sensitive information of its users. Opay offers users 25 free transactions monthly and charges N10 for every transaction afterward. Opay also supports foreign currencies like USD and EUR. Users can also secure short-term loans from Opay with minimal interest rates. Opay offers users more than just banking.

In Nigeria’s financial sector, Opay is already a household name because of its simplicity in the app navigation. Opay has more than 5 million downloads across Android and iOS app stores. This shows how popular this app is.

With all this superb service that OPay renders, Do you know that their Fintech apps do precisely the same thing that Opay does? Surprised? Don’t be; we are just getting started. This article is focused on showing you up to ten apps that are similar to Opay.

The reason why we want to show you other apps that you can use instead of Opay is that we want to give you a broader choice to make. And also so that you will select the one that best suits your needs.

Why are Fintech companies popular in Nigeria?

Do you know why E-wallet payment services are becoming more popular than traditional banks in Nigeria today? Well, if you don’t know, read this section carefully to understand why.

Unbanked population

Nigeria has a sizable unbanked populace. According to the data released by the World Bank, 60% of Nigeria’s population is unbanked, meaning that most Nigerians don’t have access to a formal banking system. This is the opportunity that Opay and other 10 apps similar to Opay saw and began working on filling the gap by providing digital banking services that are conveniently accessible and at a lower cost.

Increase in Mobile phone usage

In Nigeria today, smartphones are owned by almost all the family. According to some data published online, Nigeria has the highest smartphone penetration rate in the world, with about 100 million internet users.

The data above is enough to suggest that Nigeria is a massive market for Fintech companies. This is because their services are all mobile-based financial services, such as using a phone to send money, bill payment, and other related services.

Government support

The Nigerian Government gave a perfect landing ground for those Fintech companies. Governments support Fintech innovations and have implemented laws and policies that encourage the growth of the Fintech industry in Nigeria.

For instance, The Central Bank of Nigeria (CBN) has launched many initiatives to promote smaller Fintech startups.

Easy of getting Investors

Also, because of how lucrative the Fintech industry is in Nigeria, getting investors to invest in a Fintech startup is not difficult. Both local and international investors are willing to invest in Nigeria’s Fintech industry.

This has led to the emergence of some outstanding Fintech startup ecosystems and also an increasing number of Fintech companies that come into the industry in Nigeria.

Consumer preference

In Nigeria, more people prefer digital payment platforms than traditional banking services. They want to do every transaction on their mobile phone instead of visiting a bank.

This has created the need for Fintech service, which consumers see as a more convenient and secure way of banking.

Chance for Financial innovations

With Fintech companies trooping into Nigeria’s financial sector, the chance of innovations will be higher. This is because those Fintech companies are more interested in catering to the needs of the Nigerian market.

Some Fintech companies offer innovative services such as peer-to-peer lending, Digital savings and also offer insurance products that are designed for Nigerian consumers’ needs.

Below is the list of the top 10 Apps similar to Opay

This is the list of 10 apps that are similar to Opay.

1.. Paystack: with Paystack, users can accept payment via debit/credit cards, bank transfers, and Mobile money. The Fintech company is owned by two Nigerian tech gurus named Ezra Olubi and Akinlade. Founded in 2015, Paystack has become a successful app similar to Opay.

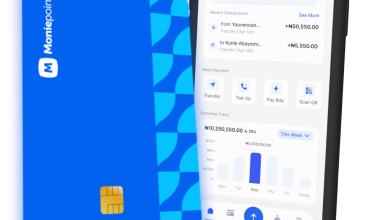

2. Moniepoint: Moniepoint is a household name in Nigeria’s Fintech industry. The company has joined the queue of Successful Fintech businesses in Nigeria. Moneypoint is similar to Opay because it does almost everything Opay can do except for a few services, such as food delivery and ride-hire. Moniepoint app has over 5 million downloads across all the app stores. Moniepoint also has a POS machine that customers use in making payments. If you are looking for Opay alternative Moniepoint app is similar to Opay.

3. Carbon: if you are interested in securing a loan, Carbon, formally known as Paylater, is an available option you should consider if Pay is not available. With carbon, you can apply for a low-interest loan ranging from a few thousand to millions of Naira. The Fintech company is owned by Chijioke Dozie and Ngozi Dozie. It was launched in the year 2016.

Like Opay, before applying for a loan, you must meet the requirements and Eligibility status.

4. Palmpay: Palmpay is another top app similar to Opay. With Palmpay, users can make payments, receive payments, bill payments, airtime purchases, etc. The app offers rewards to consistent users’. They also have a referral program where individuals are rewarded for referring their friends to Palmpay. They also have loan options where you can borrow short term loans either for your business or personal needs. To open an account with Palmpay is not difficult too.

5. Kuda : this is another Fintech app similar to Opay, it is a Nigerian Fintech company that incorporates traditional banking services into Digital mobile service. Kuda was founded in 2018 by Babs Ogundeyi and Musty Mustapha. Like Opay it offers free services such as account opening, bill payment, ATM withdrawals, through their mobile app.

Kuda also has a POS machine for merchants who want to partner with the company. Over the years Kuda has grown popular among Nigerians who need a faster and more convenient way of doing transactions.

You can download the Kuda app from Google play store or apple store depending on the device system you are using.

6. Branch: This app is also similar to Opay, only that the company is only focused on lending loans to customers. They also offer some other services such as savings. Branch was founded by Matt Flannery and Daniel Jung in 2015.

You can secure short-term and long-term loans for your businesses using Branch.

7. Renmoney: Renmoney is yet another Fintech company founded by Oluwatobi Boshoro in 2012. Remote is among the first Fintech companies to begin operations in Nigeria. Renmoney is similar to Opay and Majorly focuses on giving out loans and other financial services.

8. Cowrywise: This Fintech company was founded in 2017 by Razaq Ahmed and Edward Popoola. This app is also similar to Opay. It offers only savings and investment opportunities to its users. If you are interested in saving your income or investing your fund, Cowrywise should be on your list. With cowry wise users can invest in different assets such as stocks, bonds, and mutual funds.

One of the advantages of using cowries is that it has features that will help you luck your funds, i.e. you will not be able to withdraw your funds until the maturity period.

9. Flutterwave: Flutterwave is a Nigerian-based Fintech company similar to Opay. The company was founded by Iyioluwa Aboyeji and Agboola in 2016.

Flutterwave is only focused on helping businesses to get paid from more than 150 countries in the world. It is safe to say that Flutterwave is more of a payment gateway than a bank.

10. PAGA : This app allows users to send and receive money, make airtime purchases and bill payments right with their mobile phone. The app was founded by Tayo Oviosu in 2009. PAGA is similar to Opay. It also has POS machines across the 36 states of Nigeria.

Frequently Asked Questions (FAQs) On The Top 10 apps similar to Opay

Which app can I use instead of Opay?

There are several apps similar to Opay. Meaning that they do exactly what Opay can do or even more such apps include palmpay, Kuda, Nomba, PAGA , Flutterwave, Moniepoints etc.

How secure is an App similar to Opay?

Yes they are very secure just like Opay. Some of them use sophisticated security protocols to protect your data and information while some went further to incorporate two-factor authentication methods on their security measures.

What services do apps similar to Opay offer?

All the apps similar to Opay offer different financial services which includes: mobile money payment, buying of recharge cards, bill payment, receiving and transfers, saving and investing, and loans.

Is Moniepoint POS machine free of charge?

No, Moniepoint POS is not free of charge. Agent would pay to get them.

Can I borrow a loan from Renmoney?

Yes primarily, Renmoney is meant for securing loans. You can borrow loan once you complete all your registration and verification.

Conclusion

In summary, in the Nigeria Fintech industry, there are loads of apps similar to Opay. However, Opay still has its own uniqueness which none of those apps could be matched with. So while you explore the Opay alternative keep an eye on the amazing features of Opay.