5 Best Tips to Boost Your Chances of Personal Loan Approval

Cleaning up your credit and paying down debt are two ways to help you qualify for a personal loan.

There’s no universal formula for getting a personal loan approval. Requirements such as credit score and income vary by lender, and some online lenders consider nontraditional data, like free cash flow or education level.

But loan companies have one thing in common: They want to get paid back on time, which means they approve only borrowers who meet their requirements. Here are five tips to boost your chances of qualifying for a personal loan.

1. Clean up your credit

Your credit score is a major consideration on a personal loan application. The higher your score, the better your approval chances.

Check your reports for errors. Common errors that may hurt your score include wrong accounts, closed accounts reported as open and incorrect credit limits, according to the Consumer Financial Protection Bureau.

Until the end of 2023, you can get your credit reports for free once a week at AnnualCreditReport.com. With evidence to support your claim, dispute any errors online, in writing or by phone.

Get on top of payments. If you’re not already, be vigilant about making monthly payments toward all your debts, paying more than the minimums when possible. This will benefit your payment history and credit utilization ratio, which is the percentage of your available credit that you’re using. Together, these two factors make up 65% of a FICO credit score.

Request a credit limit increase. Call the customer service numbers on the back of your credit cards and ask for an increase. You have a better chance if your income has risen since you acquired the card and you haven’t missed any payments.

This strategy can backfire and temporarily hurt your credit score if it requires a hard pull on your credit, so ask the creditor beforehand, says Justin Pritchard, a certified financial planner based in Montrose, Colorado.

» MORE: Check your credit score for free on NerdWallet

2. Rebalance your debts and income

Loan applications ask for your annual income, and you can include money earned from part-time work. Consider increasing your income by starting a side hustle or working toward a raise at your full-time job.

Also, do what you can to pay down debt.

Boosting your income and lowering your debt improves your debt-to-income ratio, the percentage of your monthly debt payments divided by monthly income. Not all lenders have strict DTI requirements, but a lower ratio shows that your current debt is under control and you can take on more.

» MORE: How to get a personal loan with low income

3. Don’t ask for too much cash

Requesting more money than you need to reach your financial goal can be seen as risky by lenders and may make it harder to get approved.

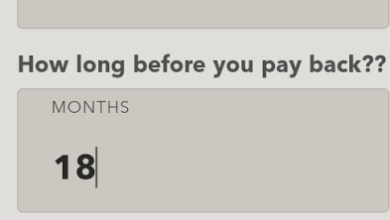

A larger personal loan also squeezes your budget, as higher loan payments impact your ability to meet other financial obligations, such as student loans or mortgage payments. Use the calculator below to estimate your potential monthly payment on a personal loan based on your desired loan amount and repayment term.

4. Consider a co-signer

If you do not have a good or excellent credit score (690 or higher), adding a co-signer with stronger credit and income can increase your chances of approval.

Because the co-signer is equally responsible for repaying the loan, it’s critical to co-sign with someone who can afford the risk, Pritchard says.

“You may have every intention of repaying the loan, but you can’t predict a job loss, disability or another event that impacts your income and ability to repay the loan,” he says.

Have an honest conversation with the prospective co-signer so they fully understand the risks before agreeing.

5. Find the right lender

Some online lenders disclose their minimum credit score requirements, loan amounts and whether they offer options like co-signers.

If you meet a lender’s minimum qualifications and want to see estimated rates and terms, you can pre-qualify for a personal loan. With most lenders, pre-qualifying triggers a soft credit pull, which does not impact your credit score.

Pre-qualify with multiple lenders and compare rates and terms. The best loan option has costs and payments that fit into your budget.