How To Go About Getting A Personal Loan Buy Cheyenne (2023)

Getting a personal loan can be a great way to finance a big purchase or consolidate existing debt, but the process can be confusing and overwhelming. In this article, we’ll walk you through the steps of getting a personal loan in Cheyenne, Wyoming, so you can make an informed decision about whether this type of loan is right for you.

What is Personal Loan?

First, it’s important to understand what a personal loan is. A personal loan is a type of unsecured loan that can be used for a variety of purposes, such as paying off credit card debt, making a big purchase, or consolidating multiple loans into one. Unlike a secured loan, such as a mortgage or car loan, a personal loan does not require collateral.

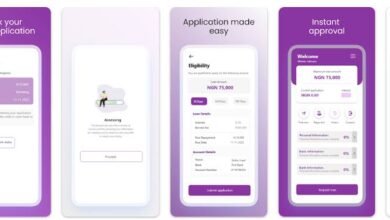

Steps To Follow To Apply for a Personal Loan in Cheyenne

1. Determine how much you need to borrow and for how long

This will assist you in narrowing your options and locating a lender who offers loans in the appropriate amount and on terms that meet your requirements.

2. Compare lenders by shopping around

Look for lenders with competitive interest rates and fees, and compare the terms and conditions of various loans to find the one that best meets your needs.

3. Gather all necessary documents

Most lenders will ask for proof of income, employment, and identification. Bank statements and other financial documents may also be required.

4. Please submit your application

Fill out the application and attach any relevant documentation.

5. Wait for a decision

Your application will be reviewed by the lender, who may request additional information. Once the lender has made a decision, they will notify you whether or not you have been approved for the loan and, if so, the loan terms.

6. Examine the loan agreement and ask questions

Make sure you understand the terms and conditions of the loan before accepting it. If you have any questions, please contact the lender.

7. Accept the loan and get the money

If you accept the loan, you must sign the loan agreement and agree to the terms. The funds will then be transferred to you by the lender.

Navigating the personal loan process can be overwhelming, but with the right information, you can find the best deal in Cheyenne. This will walk you through the steps of getting a personal loan, from understanding your credit score to comparing offers from different lenders. With the right approach, you can find the personal loan that fits your needs and your budget.

1. Credit score & Credit history

Before you start the process of getting a personal loan, it’s important to take a look at your credit score and credit history. Your credit score is a numerical representation of your creditworthiness, and it’s used by lenders to determine whether you’re a good candidate for a loan.

The higher your credit score, the more likely you are to be approved for a loan and to get a better interest rate. You can check your credit score for free through a variety of online services, such as Credit Karma or Credit Sesame.

2. Look for good lenders

Once you have a good understanding of your credit score and credit history, you can start looking for personal loan options in Cheyenne. There are a variety of lenders that offer personal loans, including banks, credit unions, and online lenders. Each lender will have its own requirements and interest rates, so it’s important to shop around and compare offers to find the best deal for you.

3. Basic information about yourself

When applying for a personal loan, you’ll typically need to provide some basic information about yourself, such as your name, address, and income. You’ll also need to provide documentation, such as proof of income and employment, and you may need to supply additional information, such as tax returns or bank statements.

4. Receive funds and repay monthly

Once your application is approved, you’ll receive the loan funds and will begin making monthly payments, typically with interest. The interest rate and terms of your loan will depend on your credit score and the lender you choose.

Conclusion

It’s important to remember that a personal loan is a big financial commitment and should be taken seriously. Make sure you understand the terms and conditions of your loan and that you can afford the monthly payments. If you’re having trouble making your payments, contact your lender right away to discuss alternative options.

In summary, getting a personal loan in Cheyenne, Wyoming can be a great way to finance a big purchase or consolidate existing debt. To get a personal loan, you need to know your credit score and history, then shop around for the best loan options, you will need to provide some basic information about yourself.

You will need to provide documentation such as proof of income and employment, you will begin making monthly payments, typically with interest. Remember to be aware of the terms and conditions of your loan and that you can afford the monthly payments.