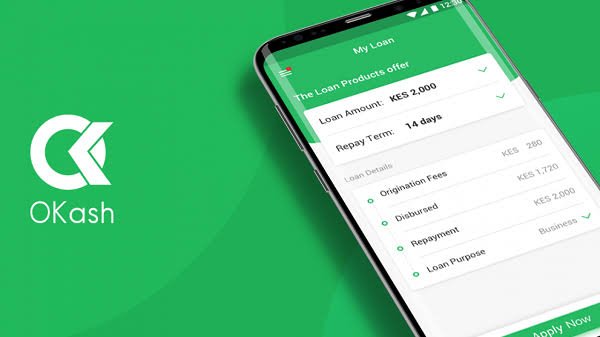

Okash Loan App: How to Apply for loan and Borrow Money from Opay Loan App OKash.

How to borrow money from Okash loan app

Okash is among the loaning apps that has revolutionized the loan game in Nigeria. This amazing lending app is owned by Opay, a subsidiary of Opera Limited and is designed to provide Nigerians with quick and easy access to financial services.

With Okash, you can easily apply for a loan and get instant access to funds to meet your urgent needs. Trust me, Okash loan app is the most popular loan app in Nigeria with over 10 million downloads on Play Store.

If you need a fast reliable loan to take care of urgent needs like paying utility or hospital bills, Okash is the app you should use. It offers a seamless borrowing experience you won’t find anywhere else.

Don’t take my word for it; Download the app and try it yourself. You will be surprised at how easy it is to apply for a loan from Okash.

Keep reading this article to learn how to register with Okash and borrow money with Opay Okash. You will not regret it.

How to create Account with Okash loan App

Creating an account with Okash is a simple and easy process. Follow these simple steps and enjoy the convenience of accessing loans quickly and easily through the Okash mobile app.

- Download the Okash mobile app from the Google Play Store: When you type Okash Loan in the Google Play Store search box, the Okash mobile app will appear. Click “Download” and wait for the installation to complete.

- Launch the application: Once the installation is complete, launch the app and select the “Create account” option. This will direct you to the registration page.

- Enter your phone number: On the registration page, enter your primary phone number and click the “Continue” button. An SMS will be sent to your phone number with a verification code.

- Check your phone message: Enter the 6-digit verification code sent to you via SMS and click the “Verify” button. This will take you to the next step in the registration process.

- Set your password: Create a strong password that you can easily remember. Enter the password in the space provided and click the “Submit” button.

- Fill out the registration form: The next step to create an account with Okash is to fill out the registration form. This includes your bio-data and contact information.

- Accept terms and conditions: Read the terms and conditions of using the Okash loan and accept them. This will allow you to move on to the next step.

Requirements for Okash loan

Below are the loan requirements of Okash, failure to meet any of them will prevent you from borrowing from the app.

1) Valid ID: Okash Loan requires borrowers to upload a valid government-issued identification card during the application process. This identification document can be a passport, driver’s license or national identity card.

2) Active phone number: Before you can access an Okash loan, you must register an active phone number in your name. The lender will use this number to contact you throughout the loan process.

3) Bank account: Okash loans are paid directly to the borrower’s bank account. Therefore, you must provide the bank account number to which you have access. Also, make sure your account is fully active.

4) Good credit history: This may not be a specific requirement, but it is important if you want to be approved for a preferential loan. Okash evaluates each borrower’s creditworthiness before approving the loan. Make sure your credit score is good by paying previous debts on time.

5) Stable source of income: Okash requires borrowers to have a stable source of income. This could be a salary, business income, or any other legitimate way of making money. Lenders will check this source of income to ensure you have the ability to repay your debt.

6) Annual Percentage Rate (APR): Okash loans have an annual interest rate of 36%. Consider the total cost of the loan before applying to avoid default. In short, it is important to meet Okash requirements if you want to easily access loans from these lenders. Make sure you have all the necessary documents before applying. With a good credit history and stable income, you can easily get an Okash loan.

How to Apply for a Loan and Borrow Money from Opay Loan App OKash.

Follow the below procedure to apply and borrow money from Okash.

- Download the OKash loan app from Google Play Store and install it on your mobile device.

- Open the app and create an account by registering with your mobile number and verifying with the OTP code.

- Enter your personal and financial information, including name, date of birth, employment status, monthly income, and bank details.

- After you submit your information, the application will analyze your creditworthiness based on internal algorithms and decide whether to approve your loan application or not.

- If your loan application is approved, the application will display the loan amount you are eligible to borrow and the repayment period.

- If you accept the loan terms, confirm your acceptance on the app and the loan amount will be credited to your bank account within minutes.

- Repay your loan within the agreed timeframe, making sure to respect all repayment schedules.

To access the best loan terms, make sure you have a good credit score, stable employment, and accurate personal and financial information. The application requires you to provide accurate and verifiable financial records to qualify for the loan.

Okash loan interest rates and type of loan

- Okash offers two types of loans, which are personal loans and business loans.

- For personal loans, interest rates range from 5% to 25% per month, depending on the loan amount and term.

- For business loans, interest rates range from 2% to 20% per month, also depending on the loan amount and term.

- Personal loan amounts vary from N1000 to N100,000, while for business loans it ranges from N100,000 to N5000,0000.

How to Repay Okash Loan Easily

To borrow money is easy but to repay back the loan is always the issue. To easily repay your loan follow these instructions.

- Set up a realistic repayment schedule – Before borrowing money from Okash, analyze your income and expenses to determine a feasible repayment plan. You can choose a weekly or monthly repayment schedule, depending on your convenience.

- Take advantage of flexible repayment options – Okash offers flexible repayment options that allow you to extend your payment term if you are unable to meet your original repayment date. You can also split your repayment into multiple payments.

- Avoid late payments or defaults – Late payments or defaults can have a significant impact on your credit score and future loans. Make sure you repay your Okash loan on time to continue enjoying the comfort of borrowing from them.

- Enable auto repayment feature – Okash offers an auto repayment option to deduct the loan installment from your account on the due date. Enabling this option ensures you won’t miss any repayment and reduces penalties for late payments.

FAQs on How to Apply for loan and Borrow Money from Opay Loan App OKash.

How to apply for a loan on OKash?

To apply for a loan on OKash, you need to download the OKash loan app from the Google Play Store. Fill out the registration form and enter the requested personal information. Once the registration process is complete, you will be able to apply for a loan by selecting the amount you need, the repayment period and the purpose of the loan.

Can I apply for a loan on OKash without a job?

Yes, you can apply for a loan on OKash even if you don’t have a job. However, you must provide other sources of income to qualify for the loan. For example, if you are self-employed or run a small business, you can use the income generated from these sources to demonstrate your ability to repay debt.

How long does it take to qualify for a loan on OKash?

After you submit your loan application on OKash, your loan will be reviewed and processed within 5-30 minutes. If your loan is approved, the loan amount will be disbursed to your bank account within minutes.

What is the interest rate on OKash loans?

Interest rates for OKash loans vary depending on the loan amount and repayment term. However, the interest rate is quite competitive compared to other lending banks on the market. For more information about interest rates, borrowers can check loan conditions before submitting loan applications.

How to repay my loan on OKash?

You can repay your loan on OKash using your Bank account. To repay the loan, go to your Okash loan app and copy the account number that Okash provided for your repayment, then go to your bank account and transfer the money. Once it’s successful Okash will automatically acknowledge your loan repayment.

Conclusion

Okash loan app is a quick way to access loans to take care of urgent or sudden needs. With Okash you can borrow money without collateral and the loan applications process and disbursement is easy and quick.