Irorun Loan Review, How to apply, App Download, Customer Care Number, Email and Address

Irorun Loan Review, How to apply, App Download, Customer Care Number, Email and Address

Irorun Loan is a Fintech lending platform based in Nigeria that offers quick and easy loans to individuals and small businesses. In this article, we’ll take a closer look at Irorun Loan reviews, how to apply for a loan using the Irorun Loan app, and what you need to know before borrowing.

Irorun Loan Reviews: What Customers Are Saying

Irorun Loan has received overwhelmingly positive reviews from its customers. Here are some of the highlights:

- Fast and Easy Application Process: Many customers have praised Irorun Loan for its quick and easy application process. The application can be completed online in just a few minutes, and most loans are disbursed within 24 hours.

- Flexible Repayment Terms: Irorun Loan offers flexible repayment terms that are tailored to each customer’s unique circumstances. This makes it easier for borrowers to manage their debt and avoid defaulting on their loans.

- Competitive Interest Rates: Irorun Loan offers competitive interest rates that are lower than those of many traditional lenders. This makes it more affordable for borrowers to repay their loans and avoid accumulating excessive interest charges.

- Excellent Customer Service: Irorun Loan has a reputation for providing excellent customer service. Customers have reported that the company’s customer service representatives are knowledgeable, responsive, and helpful in resolving any issues that arise during the loan process.

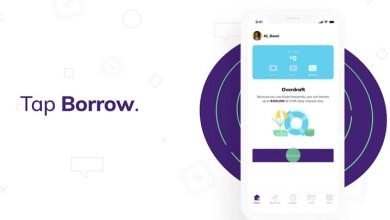

How to Apply for a Loan Using the Irorun Loan App

Applying for a loan with Irorun Loan is quick and easy. Here’s how it works:

- Download the Irorun Loan app: The app is available for download on both iOS and Android devices. Search for “Irorun Loan” in your app store and follow the prompts to download and install the app.

- Register: Once you’ve downloaded the app, you’ll need to register by providing your personal information, including your name, email address, phone number, and BVN (Bank Verification Number). You’ll also need to create a password to secure your account.

- Apply for a loan: After you’ve registered, you can apply for a loan by selecting the “Apply for Loan” option in the app menu. You’ll need to provide some additional information about your income, employment status, and other financial details. The app will then calculate your loan amount based on your income and other factors.

- Review your loan offer: Once you’ve submitted your application, Irorun Loan will review it and make a loan offer if you qualify. You can then review the terms of the loan offer, including the interest rate, repayment schedule, and other important details. If you accept the offer, the loan will be disbursed directly into your bank account within 24 hours.

What You Need to Know Before Borrowing with Irorun Loan

Before borrowing with Irorun Loan, there are a few things you should know:

- Eligibility Requirements: To be eligible for an Irorun Loan, you must be at least 18 years old, have a Next of kin, have a valid BVN (Bank Verification Number), and provide proof of income (such as a pay stub or bank statement). You must also have an active bank account into which the loan can be disbursed.

- Interest Rates: The interest rates on Irorun Loans vary depending on several factors, including your creditworthiness, loan amount, and repayment term. Interest rates typically range from 15% to 30% per annum (APR), which is lower than many traditional lenders but still higher than some other Fintech lenders in Nigeria. Be sure to carefully review the interest rate and repayment terms before accepting any loan offer from Irorun Loan or any other lender.

- Repayment Terms: Irorun Loan offers flexible repayment terms that are tailored to each customer’s unique circumstances. Repayment terms typically range from 30 days to 12 months (1 year), with interest charges accruing daily until the loan is fully repaid. Be sure to carefully review the repayment terms before accepting any loan offer from Irorun Loan or any other lender to ensure that you can afford to make timely payments without defaulting on your debt or accumulating excessive interest charges over time.

Irorun Loan Customer Care Number, Email, and Address

-

- Irorun Loan Customer Care Number: +234 1 700 5288

- Irorun loan Email Address: hello@irorun.com

- Irorun Loan Office Address: 1B, Church Street, Off Ilo-Awela Road, Ota, Ogun State.

FAQs

How to Apply for an Irorun Loan?

If you’re considering applying for an Irorun loan, the process is simple. You can start by visiting their website or downloading the Irorun app from the Google Play Store. Once you have the app, you can follow the step-by-step instructions to complete the application process. Make sure to have all the necessary documentation ready, including proof of income and identification.

App Download and Installation?

To download the Irorun app, simply go to the Google Play Store and search for “Irorun.” Once you find the app, click on the “Install” button, and the app will be downloaded and installed on your device automatically. After installation, you can open the app and proceed with the registration and application process.

Customer Care Number, Email, and Address?

If you have any questions or need assistance with your Irorun loan, you can contact their customer care team. The customer care number for Irorun is +234 1 700 5288. You can also reach out to them via email at hello@irorun.com. Additionally, if you prefer to visit their office in person, the address is Irorun Loan Office Address: 1B, Church Street, Off Ilo-Awela Road, Ota, Ogun State, Nigeria.

Conclusion

Understanding the process of applying for an Irorun loan and accessing their customer support is essential for a smooth experience. By following the steps outlined in this article, you can confidently navigate the application process and reach out for assistance when needed. We hope that the information you have read is helpful and helped you to understand a thing about the Irorun loan.