When Do Student Loans Resume? Important Information You Shouldn’t Miss

When Do Student Loans Resume? Student loans have been a topic of concern and discussion for millions of borrowers, particularly due to the significant impact of the COVID-19 pandemic.

The relief measures implemented in response to the pandemic have provided temporary relief from student loan payments for many individuals. However, with the ever-changing circumstances, it’s important to understand when student loans will resume and how to prepare for the transition.

The burden of student loans can be overwhelming, and the pandemic has added an extra layer of complexity. Many borrowers have experienced financial challenges, making the temporary suspension of student loan payments a crucial lifeline. However, as the world begins to recover and adjust to the new normal, it’s essential to be aware of the timeline for resuming student loan payments.

Overview of Student Loan Suspension

To address the financial hardships faced by borrowers during the pandemic, various relief measures were implemented, including the suspension of federal student loan payments. This temporary pause on payments provided much-needed breathing room for individuals struggling to make ends meet. It allowed borrowers to focus on immediate needs, such as healthcare, housing, and other essential expenses.

While the student loan suspension brought temporary relief, it’s important to note that these measures were not meant to be permanent solutions. The suspension was put in place as an emergency response to the unprecedented circumstances caused by the pandemic.

When Do Student Loans Resume?

Now, the question arises: When do student loans resume? The current status of student loan payments depends on various factors, including government decisions and legislative actions. As of the latest information available, the temporary suspension of federal student loan payments is scheduled to end on a specific date.

However, it’s essential to stay updated with official announcements and consult reliable sources, such as the U.S. Department of Education or your loan servicer, for the most accurate and timely information regarding the resumption of student loan payments.

Preparing for Student Loan Repayment

To avoid any last-minute surprises or financial setbacks, it’s crucial to be prepared for the resumption of student loan payments. Here are some proactive steps you can take to ensure a smooth transition:

1. Assess Your Financial Situation

Evaluate your current financial situation and determine how you can adjust your budget to accommodate student loan payments. Take into account your income, expenses, and any potential changes in your circumstances.

2. Create a Repayment Plan

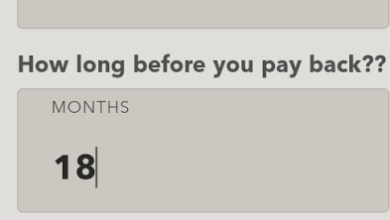

Develop a repayment plan that suits your financial goals and aligns with your budget. Consider the various repayment options available, such as income-driven repayment plans or extended repayment plans. Choose the option that best fits your needs and enables you to manage your loan payments effectively.

3. Seek Financial Assistance

If you’re facing financial difficulties or anticipate challenges in resuming student loan payments, explore the assistance programs offered by the government or private organizations. These programs can provide support, guidance, and potential solutions to alleviate your financial burden.

Potential Changes to Student Loan Policies

It’s worth noting that discussions surrounding potential changes or reforms to student loan policies are ongoing. Lawmakers and policymakers recognize the need for addressing the challenges faced by borrowers and may introduce new legislation or initiatives to help alleviate the burden of student loan debt. Stay informed about these developments and advocate for policies that can positively impact your financial situation.

Implications for Borrowers

When student loans resume, there may be implications for borrowers. Interest may have accrued during the suspension period, and loan balances may have changed. It’s important to review your loan details and understand the impact of these changes on your repayment journey.

Managing Student Loan Debt

Effectively managing student loan debt is crucial for your financial well-being. Here are some strategies to consider:

1. Make Timely Payments

Ensure you make your student loan payments on time to avoid any penalties or additional charges. Set reminders or automate your payments to stay on track.

2. Explore Consolidation and Refinancing

Consolidating your loans or refinancing them can help simplify your repayment process or secure better loan terms. However, carefully evaluate the pros and cons before making any decisions, as this may impact your eligibility for certain benefits or forgiveness programs.

The Importance of Financial Education

Finally, it’s crucial to emphasize the significance of financial education in navigating the complexities of student loan repayment and overall financial management. Improving your financial literacy can empower you to make informed decisions and optimize your financial well-being. Explore educational resources, attend workshops, or seek guidance from financial professionals to enhance your understanding of personal finance.

Conclusion

In conclusion, the temporary suspension of student loan payments provided relief to borrowers during the COVID-19 pandemic. However, it’s important to stay updated with official announcements and prepare for the resumption of student loan payments. Assess your financial situation, create a repayment plan, and seek assistance if needed. Stay informed about potential changes to student loan policies and proactively manage your student loan debt. By taking these steps, you can navigate the transition with confidence and work towards achieving financial stability.

When Do Student Loans Resume FAQs

Q: What happens if I can’t afford to resume student loan payments?

If you’re unable to afford the regular student loan payments, you may explore alternative repayment options such as income-driven repayment plans or hardship deferments. Contact your loan servicer to discuss the available options and find a solution that works for your financial circumstances.

Q: Can I apply for an extension to the student loan suspension?

The availability of extensions to the student loan suspension depends on government decisions and legislation. Stay updated with official announcements to know if extensions or additional relief measures are implemented.

Q: Are there any forgiveness programs for student loans?

Yes, there are forgiveness programs available for certain types of student loans. For example, Public Service Loan Forgiveness (PSLF) is an option for individuals working in eligible public service jobs. Explore the forgiveness programs that align with your circumstances and consider their requirements and benefits.

Q: How can I find out the current status of my student loans?

To determine the current status of your student loans, visit the official website of your loan servicer or log in to your online account. You can also contact your loan servicer directly for personalized information regarding your specific loan details.

Q: Will interest rates change when student loans resume?

Interest rates on federal student loans are fixed and generally do not change over time. However, if you have private student loans, the terms and conditions, including the interest rate, may vary depending on the lender.

Q: Can I choose a different repayment plan after the suspension ends?

Yes, you can explore different repayment plans even after the suspension ends. Research the available options and consult with your loan servicer to determine the most suitable plan for your financial situation.

Q: What are the consequences of defaulting on student loans?

Defaulting on student loans can have serious consequences, including damage to your credit score, wage garnishment, and legal action. It’s essential to contact your loan servicer as soon as possible if you’re facing difficulties in making payments to explore alternative solutions.

Q: Can I negotiate with my loan servicer for better terms?

While it may be possible to negotiate certain aspects of your loan terms, such as repayment options or interest rates, it depends on your loan servicer’s policies and guidelines. Contact your loan servicer to discuss potential options and negotiate based on your circumstances.

Q: Are there any alternative options for paying off student loans?

In addition to regular payments, you can consider alternative options such as making extra payments, refinancing your loans, or exploring loan forgiveness programs. Each option has its own implications and considerations, so research thoroughly and choose the path that aligns with your financial goals.

Q: How can I protect my credit score during this transition?

To protect your credit score during the transition, ensure you make timely payments and communicate with your loan servicer if you encounter challenges. Keeping a consistent payment record and addressing any issues proactively can help maintain a healthy credit score.

One Comment