Tonik Loan is a digital banking platform based in the Philippines that offers various financial products, including loans, savings accounts, and investment options. Tonik Loan is a legitimate company regulated by the Bangko Sentral ng Pilipinas (BSP), the country’s central bank and financial regulator.

Tonik Loan’s loan products are available to Filipino citizens and residents who meet the eligibility criteria. To qualify for a Tonik Loan, applicants must have a stable source of income, a valid government-issued ID, and a mobile number registered in their name. The loan amount and interest rate depend on the borrower’s credit profile and repayment capacity.

Tonik Loan offers two types of loans: FlexiLoan and FlexiSaveLoan. FlexiLoan is an unsecured personal loan that can be used for various purposes, such as emergency expenses, debt consolidation, or business needs. The loan amount ranges from PHP 5,000 to PHP 150,000, with a repayment period of 6 to 36 months. The interest rate starts at 2% per month for prime borrowers with excellent credit scores.

FlexiSaveLoan is a unique product that combines a savings account and a loan facility in one. Borrowers can apply for a FlexiSave loan by opening a Tonik Save account and depositing an initial amount of PHP 10,000. The loan amount is based on the savings balance, with an interest rate of 1% per month for prime borrowers. The repayment period is flexible, ranging from 6 to 36 months, with the option to repay the loan in full or in installments.

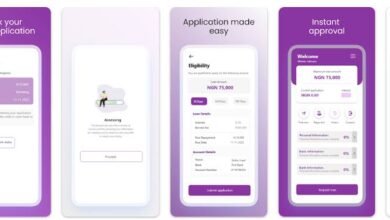

Tonik Loan’s loan application process is fully digital and can be completed within minutes using the Tonik app or website. Borrowers can track their loan status and repayment schedule through the Tonik app’s dashboard. Tonik Loan also offers various features to help borrowers manage their finances, such as automatic repayments, overdraft protection, and credit score monitoring.

Tonik Loan App Download

Tonik is a digital bank and financial technology company that offers various financial services, including personal loans. Here’s where you can download the Tonik loan app:

- Google Play Store (Android devices): You can easily download the Tonik loan app from the Google Play Store by following these steps:

- Open the Google Play Store app on your Android device.

- Tap on the search bar at the top of the screen and type “Tonik loan app.”

- Select “Tonik Bank” from the search results.

- Tap on the “Install” button to begin downloading the app.

- Once the download is complete, open the app and follow the instructions to create an account or log in if you already have an account.

- App Store (iOS devices): If you have an iPhone or iPad, you can download the Tonik loan app from the App Store by following these steps:

- Open the App Store app on your iOS device.

- Tap on the search bar at the bottom of the screen and type “Tonik loan app.”

- Select “Tonik Bank” from the search results.

- Tap on the “Get” button to begin downloading the app.

- Once the download is complete, open the app and follow the instructions to create an account or log in if you already have an account.

It’s important to note that before downloading any loan app, including the Tonik loan app, it’s always a good idea to do your research and make sure it’s a legitimate and reputable company. Additionally, be sure to read and understand the terms and conditions of any loan agreement before signing up for a loan through any app or financial institution.

How to Apply Tonik Loan from the App.

Applying for a loan through Tonik’s mobile app is a quick and convenient process. Here’s a step-by-step guide on how to apply for a Tonik loan using their app:

- Download and Install the Tonik App: First, you need to download and install the Tonik app from the App Store or Google Play Store. The app is free to download, and it’s available for both iOS and Android devices.

- Sign Up or Log In: Once you’ve installed the app, you can either sign up as a new user or login if you already have an account with Tonik. If you’re a new user, you’ll need to provide your personal information, such as your full name, email address, and mobile number. You’ll also need to create a password.

- Fill Out the Loan Application Form: After signing up or logging in, you’ll be directed to the loan application form. Here, you’ll need to provide some basic information about yourself, such as your employment status, monthly income, and employment duration. You’ll also need to provide details about the loan you’re applying for, such as the loan amount, repayment term, and purpose of the loan.

- Upload Required Documents: Tonik requires some documents to verify your identity and employment status. You can upload these documents directly through the app. The required documents include:

- A valid government-issued ID (e.g., driver’s license, passport)

- Proof of income (e.g. bank statement)

- A recent utility bill (e.g., water or electric bill) with your name and address on it

- Submit Your Loan Application: After filling out the application form and uploading all required documents, you can submit your loan application through the app. Tonik will review your application and let you know if it’s approved or not within a few minutes to an hour. If your application is approved, you’ll receive the funds directly into your bank account within 24 hours.

- Repay Your Loan: When it’s time to repay your loan, you can do so directly through the app using your debit card or bank account details. Tonik offers flexible repayment options that allow you to choose a repayment schedule that works best for you. You can also make early repayments without any penalties or fees.

FAQs

What is Tonik Loan and How Does It Work?

Tonik Loan is a popular loan app in the Philippines that provides fast and convenient access to credit for individuals seeking financial assistance. The app is user-friendly and allows users to apply for loans directly from their mobile devices. Tonik Loan offers flexible repayment terms and competitive interest rates, making it an attractive option for those in need of quick funds. To apply for a loan, users simply need to download the Tonik Loan app, complete the registration process, and submit the required documents for verification. Once approved, funds are disbursed directly to the user’s bank account, providing a seamless and efficient borrowing experience.

What Are the Eligibility Requirements for Tonik Loan?

To be eligible for a Tonik Loan, applicants must meet certain criteria set forth by the lending company. Potential borrowers must be at least 18 – 55 years old and have a valid government-issued ID. Additionally, applicants are required to have a stable source of income and a good credit history. The app uses advanced algorithms to assess the creditworthiness of applicants, taking into account various factors such as income stability and financial behavior. Meeting these eligibility requirements increases the likelihood of approval for a Tonik Loan, allowing individuals to access the funds they need with ease.

Conclusion

Tonik Loan is a legitimate digital banking platform that offers competitive loan products to Filipino citizens and residents. Its FlexiLoan and FlexiSaveLoan products provide flexible repayment options and competitive interest rates for prime borrowers. Tonik Loan’s digital application process and user-friendly app make it an attractive option for tech-savvy borrowers looking for convenient and accessible financial services.