Tloan Loan App Apk Download, Requirements, Interest rates, Customer Care Number, Email Address.

Tloan Loan App Apk Download, Requirements, Interest rates, Customer Care Number, Email Address.

Tloan is a digital lending platform that offers quick and easy loans to individuals in need of financial assistance. The Tloan loan app is available for download on Android devices only, making it convenient for users to access the platform from anywhere at any time.

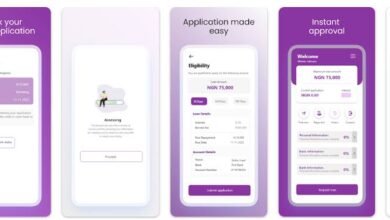

The Tloan loan app offers a variety of loan products, including personal loans, business loans, and salary loans. Users can apply for a loan through the app, which involves filling out a simple online application form. The app uses advanced algorithms to process the application quickly and accurately, providing users with an instant decision on their loan application.

One of the unique features of the Tloan loan app is its user-friendly interface, which makes it easy for users to navigate and use. The app also offers a range of repayment options, allowing users to choose a repayment plan that suits their financial situation.

In terms of security, Tloan takes all necessary measures to protect user data and ensure the safety of their loans. The app uses advanced encryption technology to secure user data, and all loans are disbursed through secure channels to prevent fraud and misuse.

Tloan Loan App Apk Download

To download the Tloan loan APK, users can visit the official website of Tloan and click on the ‘Download App’ button. The APK file will be downloaded to the user’s device, which they can then install and use. The app is free to download and use, with no hidden charges or fees.

Tloan loan Requirements and Interest rates

Tloan, a leading Nigerian loan company, offers quick and convenient loan solutions to individuals in need of financial assistance. The company’s loan products are designed to cater to different financial needs, from short-term emergency loans to long-term personal loans. In this article, we’ll take a closer look at the requirements and interest rates for Tloan loans.

Requirements for Tloan Loans

To apply for a Tloan loan, you must meet the following requirements:

- Be a Nigerian citizen aged 18 years or older.

- Have a valid bank account in your name with a Nigerian bank.

- Provide a means of identification, such as a national ID card, driver’s license, or international passport.

- Provide proof of income, such as a salary slip or bank statement showing regular inflows.

- Have an active phone number and email address for communication purposes.

- Agree to the terms and conditions of the loan agreement.

Interest Rates for Tloan Loans

Tloan offers competitive interest rates on its loans, which vary based on the loan amount and repayment period. Here’s a breakdown of the current interest rates:

- Short-term Emergency Loans (up to N50,00): Interest rate of 5% per month (equivalent to 60% per annum).

- Medium-term Personal Loans (N50,00 – N500,00): Interest rate of 4% per month (equivalent to 48% per annum).

- Long-term Personal Loans (N500,00 – N2,000,00): Interest rate of 3% per month (equivalent to 36% per annum).

It’s essential to note that late payment fees may apply if you fail to make your loan repayments on time. The late payment fee is 1% of the outstanding balance per month, with a maximum fee of N15,00 per month. Additionally, Tloan may charge an administrative fee of N5,00 upon loan disbursement to cover processing costs.

Tloan Customer Care Number, Email Address

If you want to contact Tloan Customer Care through their Email Address and phone number here is their official contact address.

Phone: +2348034063318

Email: tingoserviceng@gmail.com

FAQs

1. What is a Tloan and how does it differ from traditional loan options in Nigeria?

Tloan is a digital loan company based in Nigeria that offers quick and convenient loans to individuals in need of financial assistance. Unlike traditional loan options, which may require collateral or a lengthy application process, Tloan offers unsecured loans that can be applied for and disbursed within minutes through its mobile app or website. This makes it an attractive option for individuals who need funds quickly and without the hassle of visiting a physical branch.

2. What types of loans does Tloan offer, and what are the repayment terms?

Tloan offers two types of loans: instant loans and salary loans. Instant loans are short-term loans that can be repaid within 30 days, while salary loans are designed to help individuals bridge the gap between paychecks and can be repaid in 30-90 days. Interest rates for both types of loans range from 5% to 25% per month, depending on the borrower’s creditworthiness. Tloan also offers flexible repayment options, allowing borrowers to choose a repayment plan that suits their needs.

3. How does Tloan determine a borrower’s creditworthiness, and what factors are considered?

Tloan uses a proprietary algorithm to assess a borrower’s creditworthiness based on several factors, including their income level, employment status, credit history, and transactional data from their bank accounts. This allows the company to make informed lending decisions quickly and accurately. Borrowers with a stable income and good credit history are more likely to be approved for larger loan amounts and lower interest rates.

4. How secure is my personal information when applying for a loan with Tloan?

Tloan takes the security of its customers’ personal information very seriously and has implemented strict measures to protect against data breaches and unauthorized access. The company uses SSL encryption to secure all data transmitted between its app and website, and all customer data is stored on secure servers with restricted access. Tloan also follows strict data protection policies and adheres to all relevant regulatory requirements to ensure the confidentiality and integrity of its customers’ information.

Conclusion

In summary, Tloan offers flexible loan solutions with competitive interest rates and straightforward requirements for eligible borrowers. If you need financial assistance and meet the requirements listed above, consider applying for a Tloan loan today! Remember to always read and understand the terms and conditions of the loan agreement before signing any documents.