Is Okash Loan Registered with CBN, Does Okash Call Your Contacts, Okash Defaulters.

Is Okash Loan Registered with CBN, Does Okash Call Your Contacts, Okash Defaulters.

Are you in urgent need of some extra cash? Meet Okash, the micro-lending product provided by Blue Ridge Microfinance bank. With Okash, you can access quick loans to meet your immediate financial needs. This article will address three frequently asked questions about Okash, helping you gain a better understanding of this convenient loan app. In this article, we will provide you with a comprehensive overview of the OKash loan app, addressing common questions and concerns to help you make an informed decision.

Is OKash Loan Registered with CBN?

When it comes to borrowing money, it’s essential to ensure that the lender is registered and operates within the legal framework. In the case of OKash, you can rest assured that it is a legitimate and registered loan app with the Central Bank of Nigeria (CBN). Being regulated by the CBN ensures that OKash adheres to the necessary guidelines and regulations, providing users with a secure and trustworthy lending platform.

Is OKash Loan Legit?

With the proliferation of loan apps in the market, it’s natural to have concerns about their legitimacy. However, OKash stands apart as a reputable and reliable lending platform. OKash has garnered a solid reputation for its transparent loan repayment terms, efficient customer service, and timely disbursal of loans. Countless satisfied customers vouch for the legitimacy and effectiveness of OKash loan app, making it a trusted choice among borrowers.

Does OKash Call Your Contacts?

One aspect of OKash’s loan recovery process that some borrowers find concerning is the calling of contacts. When you borrow money from OKash, it is important to understand their loan recovery strategies. OKash may need to contact your references or emergency contacts if you fail to repay your loan on time. While some borrowers may view this as an infringement on privacy, it is a necessary measure to encourage loan repayment and deter defaulters. It’s important to remember that OKash takes privacy seriously and only calls contacts as a last resort to recover loans.

Who are OKash Loan Defaulters?

Defaulting on a loan not only impacts your financial credibility but also carries legal consequences. OKash loan defaulters are individuals who fail to repay their loans within the agreed-upon timeframe. If you find yourself in a situation where you are unable to repay your loan, it is crucial to communicate with OKash and explore alternative options. Ignoring your loan obligations can lead to financial penalties, a decrease in credit score, and potential legal actions.

Download Okash App from Google play store

If you want to Download Okash app from Google play store client here – Download Okash app

Frequently Asked Questions on Okash Loan App

How can I download Okash and set up my loan account?

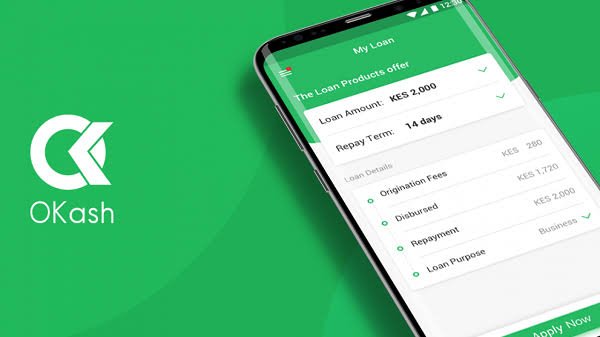

If you’re interested in using Okash to access quick loans, the first step is to download the app from Google Play. Once you have the app installed on your device, follow these simple steps to set up your loan account:

- Launch the Okash app on your smartphone or tablet.

- Complete the registration process by providing the necessary personal details.

- Select your preferred bank account to receive the loan disbursement.

- Link your active bank card to your Okash account for easy repayment.

- Fill out a set of questions provided on the app to assess your eligibility for a loan.

- Submit your loan application and wait for a decision.

Within minutes, you will receive a notification regarding the status of your loan application.

How does Okash make loan decisions so quickly?

Okash is designed to provide borrowers with speedy loan decisions, thanks to its efficient and paperless loan application process. The app utilizes advanced algorithms and data analysis to determine loan eligibility and assess creditworthiness. This allows Okash to evaluate loan applications in a matter of minutes, ensuring you receive a timely response. With Okash, you no longer have to endure long waiting times or complicated procedures. The app simplifies the loan application process, making it quick and stress-free.

What are the advantages of using Okash for loans?

Choosing Okash as your go-to loan app offers several advantages that make it stand out from traditional lending options. Here are some key benefits of using Okash:

- Speed and Convenience: Okash provides an incredibly fast and convenient loan application process. From downloading the app to receiving the loan decision, everything is done seamlessly within the app. This eliminates the need for time-consuming paperwork and lengthy waiting periods.

- Minimal Documentation: Unlike traditional lending institutions, Okash requires minimal documentation to process your loan application. With just a few simple questions and the necessary personal details, you can submit your loan application and receive a decision within minutes.

- Flexible Loan Amounts: Okash offers a range of loan amounts that can cater to your specific financial needs. Whether you require a small loan for emergency expenses or a larger sum for a major purchase, Okash has got you covered.

- Competitive Interest Rates: Okash strives to provide its borrowers with competitive interest rates. This ensures that you can access funds at a reasonable cost, without the burden of exorbitant interest charges.

Conclusion

OKash loan app offers a seamless and convenient solution to your financial needs. With its quick loan application process, hassle-free repayment options, and adherence to regulatory standards, OKash emerges as a trustworthy micro-lending product. Whether you’re facing an emergency or need funds for personal use, OKash provides immediate financial assistance without the burden of excessive paperwork. Remember, responsible borrowing and timely repayment are key to maintaining a healthy credit profile and unlocking future loan opportunities. So, download OKash from Google Play today and experience a reliable lending platform that prioritizes your financial well-being.