is 9Credit Loan Legit? How to apply, Interest Rate, App Download, How to Repay.

is 9Credit Loan Legit? How to apply, Interest Rate, App Download, How to Repay.

9credit Loan app is a digital lending platform that provides quick and convenient access to short-term loans for individuals in Nigeria. The app is owned and operated by 9credit Financial Services Limited, a licensed financial institution regulated by the Central Bank of Nigeria (CBN).

The 9credit Loan app offers loans ranging from N5,000 to N100,000, with repayment terms of up to 6 months. The application process is simple and can be completed entirely online, with no need for physical documentation or collateral.

One of the key benefits of the 9credit Loan app is its convenience. Users can apply for a loan, receive approval, and receive funds directly into their bank account within minutes. This makes it an ideal solution for individuals who need quick access to cash for unexpected expenses or emergencies.

is 9Credit Loan Legit?

In terms of security, the 9credit Loan app uses industry-standard encryption technology to protect user data and transactions. The platform also adheres to strict regulatory standards and complies with all relevant laws and guidelines. This provides users with peace of mind and assurance that their information is safe and secure.

In response to concerns about the legitimacy of digital lending platforms in Nigeria, it’s important to note that 9credit Financial Services Limited is a licensed financial institution that operates within the regulatory framework established by the CBN. This provides users with legal protection and recourse in the event of any disputes or issues.

How to apply for a 9credit loan

In this step-by-step guide, we’ll take you through the process of applying for a loan on the 9Credit platform.

-

- Launch 9Credit App: The first step in applying for a loan on 9Credit is to open their App on your mobile device. Once you’re on the homepage, click on the “Apply Now” button located at the top right corner of the page.

- Register or Log in: If you’re a new user, click on the “Register” button to create an account. If you already have an account, click on the “Log in” button and enter your login details.

- Fill in your details: After logging in or registering, you’ll be prompted to fill in your details such as your name, date of birth, email address, and phone number. Make sure all your details are accurate and up-to-date.

- Provide your employment and income details: Next, you’ll be asked to provide your employment and income details. This includes your job title, company name, monthly income, and employment duration. Make sure you provide accurate information as this will determine your loan eligibility.

- Input your loan amount and repayment period: Once you’ve provided your employment and income details, you’ll be asked to input the loan amount you wish to borrow and the repayment period (in months). The loan amount and repayment period will depend on your income level and other factors such as credit history.

- Review and submit your application: After filling in all the required information and uploading any necessary documents, review your application carefully to ensure everything is correct. Once you’re satisfied with your application, click on the “Submit” button to send it to 9Credit for review.

- Wait for approval or rejection (optional): After submitting your application, you’ll receive an email or SMS notifying you of its status. If your application is approved, you’ll receive the loan amount within a few hours (subject to bank processing times). If your application is rejected, you’ll be notified of the reason for rejection and provided with suggestions on how to improve your chances of approval in future applications.

9credit Interest Rate

The interest rates for loans on the 9credit platform range from 2.5% to 36% per annum. However, it’s essential to note that these rates are subject to change and may vary based on individual circumstances.

Borrowers need to understand the interest rate and associated fees before taking out a loan to ensure they can afford the repayments. Borrowers should also consider other factors such as repayment terms, late payment fees, and any other charges that may apply.

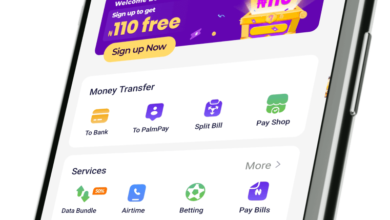

9credit App Download

This innovative lending platform offers a simple and secure way to apply for loans directly from your smartphone. Here’s where you can download the 9credit app:

- Google Play Store: The 9credit app is available for download on the Google Play Store, which is pre-installed on most Android devices. Simply search for “9credit” in the Play Store, and click “Install” to begin the download process.

- App Store: If you’re an iPhone or iPad user, you can download the 9credit app from the App Store. Again, search for “9credit” in the App Store, and click “Get” to begin the download.

- 9credit website: If you prefer to download the app directly from the source, you can visit the 9credit website (https://www.9credit.com/) and click on the “Download App” button located at the bottom of the page. This will take you to a page where you can select your device (Android or iOS) and be redirected to either the Google Play Store or App Store to complete the download.

How to Repay 9credit loan through the App

- Log in to Your Account: Once you’ve installed the app, open it and click on “Log in.” Enter your registered phone number and password to log in to your account. If you haven’t registered yet, click on “Register” to create an account.

- View Your Loan Details: After logging in, click on “Loan History” to view your loan details. Here, you’ll see all the loans you’ve taken with 9credit, including the loan amount, interest rate, repayment schedule, and repayment status.

- Select Your Loan to Repay: Choose the loan you want to repay by clicking on it. You’ll be taken to a page that displays your repayment schedule and the remaining balance due.

- Make Payment: To make payment, click on “Repay Now.” Enter the amount you want to pay and click on “Pay.” You can also select the “Auto-repay” option if you want your loan to be automatically repaid at each due date. This option is convenient for borrowers who prefer not to remember their repayment dates.

- Confirm Payment: After making payment, you’ll receive a confirmation message from 9credit. This message will contain details of your repayment, including the amount paid, transaction ID, and new loan balance. Keep this message as proof of payment for your records.

FAQs

Is 9Credit Loan Legit?

When considering a loan service, it’s natural to be cautious about legitimacy. 9Credit Loan is a reputable and legitimate loan service that operates with full compliance with regulatory standards. The company has garnered trust from numerous users and adheres to strict privacy and security measures, ensuring that customer information is handled with the utmost care.

How to Apply for a 9Credit Loan?

Applying for a 9Credit loan is a streamlined process. Simply download the 9Credit app from the App Store or Google Play, and follow the user-friendly interface to register and submit your loan application. The app provides a seamless experience, allowing users to input necessary information, upload required documents, and receive real-time updates on the status of their loan application.

Conclusion

9Credit Loan offers a legitimate and user-friendly loan service, with clear terms and a seamless application process. The app’s intuitive interface and transparent communication of interest rates make it a reliable choice for individuals seeking financial assistance.