Moniepoint Signup and Registration: How to Open an Account with Moniepoint, How to use Moniepoint App for Payments, Sending and Receiving Money

Moniepoint Signup and Registration:

Moniepoint is a digital payment platform that operates in Nigeria. Moniepoint is owned by TeamApt Limited, a Fintech company based in Lagos, Nigeria. It allows users to receive, send, and pay using smartphones. Moniepoint is a very secure digital payment service that enables customers to carry out financial transactions without carrying physical cash.

Moniepoint is not only used for financial services, it is also used for other related financial services such as:

- Bill payment

- Airtime purchase

- Fund transfer

- Fund withdrawal.

This service is rendered through Moniepoint’s point of sale (POS) machine through designated agent nationwide

Moniepoint has grown to be among the top leading Fintech platforms in Nigeria; they have become the choice for businesses and individuals who want to carry out financial transactions.

Advantages of having an account with Moniepoint

Opening a Moniepoint account has several benefits you may want to check out, as it will help you decide if you will have an account with them or not.

- Convenience of use: once you have a moniepoint account, you can perform several financial tasks and other related services from the comfort of your home. You can use Moniepoint to deposit, withdraw, transfer, bill payments, and purchase.

- Accessible: Moniepoint has an extensive network of agents spread across different states and locations in Nigeria, making it easy for users to access their services.

- Fast transfers: with moniepoint, you are assured of quick and secured money transfers; once someone makes a payment into your account, you are sure to receive it instantly.

- Low transaction fees: Like every other digital payment platform, Moniepoint offers a lower transaction rate when compared to the traditional banking system. This makes moniepoint an ideal option for low income earners.

- 24/7 availability: Moniepoint services are available 24/7; customers can perform any financial transactions anytime and from anywhere if you have an internet connection on your smartphone.

- Easy account management: Moniepoint easy-to-use mobile app that allows users to manage their accounts easily, view transaction history, and track their balances.

- Safe and secure: Moniepoint doesn’t joke with customers’ security; they use state-of-the-art security measures to ensure that customers’ details are well protected from malicious attacks.

Documents needed for Moniepoint account opening.

Before you begin to open your Moniepoint account, we must show you all the documents you need so that you can prepare them, as this will make your application more straightforward and simple. Below are the documents required by the moniepoint account opening.

-

- A valid means of identification. You will be required to prove any government-issued I.D. card. You can use any of the following: National ID Card, Driver’s license, or international passport.

- A recent passport photograph: you will need a clean snapped passport for your profile picture.

- Utility bill or bank statement: This document should not be more than three months. The documents should contain your full official name and your residential address.

- Completed account opening forms: you can get this form from any Moniepoint branch nationwide or from Moniepoint accredited agents.

- Proof of address: (electricity bill, water bill, tenancy agreement, or land use receipt)

Kindly note that the requirements may differ based on the type of account. It is essential to confirm with the Moniepoint agent or relevant staff and obtain a comprehensive list of requirements.

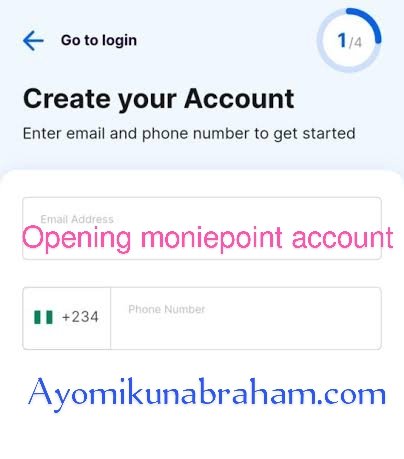

Moniepoint Signup and Registration: Step-by-Step Guide on How To Open a Moniepoint Account

In this section, we’ll show you how to open a moniepoint account from the comfort of your room. It is not a difficult task, but you need to read and understand each step below.

Below is the step-by-step guide on how to create a Moniepoint account.

1.. Download Moniepoint App: Moniepoint App is available for both Android-powered phones and iOS systems. The first step is to go to your Google play store or apple play store to download the app. Once you download it, your device will automatically install it. You can also download the APK version of this app from Moniepoint’s website.

2.. Sign-up for the Moniepoint App: Once you downloaded the app, launch it and click the Sign-up option. You can also Sign-up from Moniepoint’s website homepage.

- Enter your contact details: After clicking on Sign-up, a page or interface will pop out; you must fill that page accurately. You should make sure that no mistake is made. And also, remember to arrange your name if it was captured in your BVN. Also, use your functional email address and mobile phone number.

- Set up your 4-Digit Password: you must set up your four digits security password. This password is to protect your account details. Don’t share it with any person. Choose the numbers that you can easily remember.

- Choose your preferred account type

Moniepoint account is of two types, personal or Business. A personal account is used solely for individual use, while a business account is used by Marchant. At this stage, you have to indicate the type of account you need. Also, remember that each account has its required documents, as you have to inquire before proceeding.

- Confirm your email address and phone number by following the instructions sent to you. This is the most crucial aspect of Moniepoint account opening. You have to ensure that the email you used while filling out the contact information is in full function. A one-time password will be sent to that email, and you will be required to input the password sent to you in 6-digit columns. Once you finish that, you have successfully confirmed your email address. You will also use the procedure to verify your phone number.

- Complete the KYC verification process by providing your BVN (Nigeria only): Central Bank of Nigeria has made it compulsory that any financial institution must carry out verification known as Know your customer (KYC). And moniepoint is not different from other Fintech companies. To complete your KYC verification, you must input your BVN, as this would make it faster for them to capture your details.

- Set up your Moniepoint wallet: once you complete your KYC verification, the next thing to do is to link your Moniepoint account to your other bank account or fund your account using any of the supported payment methods.

- Started Using Your Moniepoint Account: At this stage, you can use your Moniepoint account to carry out any financial transactions or perform any related services. You can use your account to make payments, receive funds, pay bills, recharge your phone, and carry out any other transactions on the platform.

How to use a Moniepoint account to make Payments.

Using a Moniepoint account to make payments for goods and services is not a tedious task to do. It is easy to do. Below are simple steps that you can follow and do that.

- Open your Moniepoint account app and ensure you have enough money in it. If not, your payment transaction won’t go through.

- Look for the “Pay with Moniepoint” option on the merchant’s payment page.

- Enter the details of the person you want to transfer funds to, which include the account number and others.

- Enter the amount you want to pay and click the “Pay” button.

- You will receive a notification confirming the success or failure of your transaction.

Note: Moniepoint is a Nigerian payment platform that operates mainly through agents, POS, or mobile apps and is used to make withdrawals and transfer funds.

How to use a Moniepoint account to Receive payment.

There are two ways or methods one can use a Moniepoint account to receive payment. This means that specific steps for each method vary. We will tell you about the two procedures for receiving funds with a moniepoint account.

The first method is when you are requesting payment from another moniepoint Marchant.

- Log in to your Moniepoint account.

- Go to the “Receive Payment” section.

- Select the method of payment you want to use (such as bank transfer or QR code).

- Enter the amount you want to receive and the details of the payment.

- Verify the payment details and submit the request.

- Wait for the payment to be completed and appear in your Moniepoint account.

The second method is when you are requesting payment from a non-Moniepoint Marchant.

- Share your moniepoint account details with the customer.

- The customer makes payment into the account.

- Moniepoint sends you a notification that your account has been credited through email and message.

- Log into your moniepoint account and see the funds sent.

FAQs

Here are the answers to some questions regarding using the Moniepoint e-banking system.

How can I upgrade my moniepoint account?

You can upgrade your moniepoint account by completing your KYC verification. To do this, log in to your Moniepoint app, scroll to the KYC verification page, complete the verification using your BVN, and in a few minutes, your account will be upgraded.

How can I download the moniepoint app for Android phone?

To download the Moniepoint app on your Android phone, go to the Google play store and click the Search button. Input the moniepoint name and click on it. It will automatically download and install on your Android phone.

Which Bank operates moniepoint?

Moniepoint is not operated by any bank. However, the Fintech company was founded under the name imprint “TeamApt” to provide back-end financial services to Nigerians. CBN fully licensed Moniepoint in 2022.

Can I use the Moniepoint app on my phone?

Moniepoint app is made for smartphones, so with that, we can say yes. You can use the Moniepoint app on your Android or iOs phones.

Do Moniepoint App consume my phone space?

Even though Moniepoint app consume space in your phone it’s is nothing as it won’t affect your phone performance.

Conclusion

In summary, moniepoint is a digital payment platform that can be used to make payments, receive funds and also carry out other related financial services. Opening an account with Moniepoint comes with many benefits that overshadow its disadvantages. Making payments and receiving funds through a moniepoint account is relatively easy, faster, cheap, and secure.