Renmoney is a well-known financial institution in Nigeria that offers flexible lending options to its clients. The company was established in 2012 and has since been providing personalized financial solutions to its clients. Renmoney specializes in personal and business loans and offers a variety of loan packages to suit different needs and budgets.

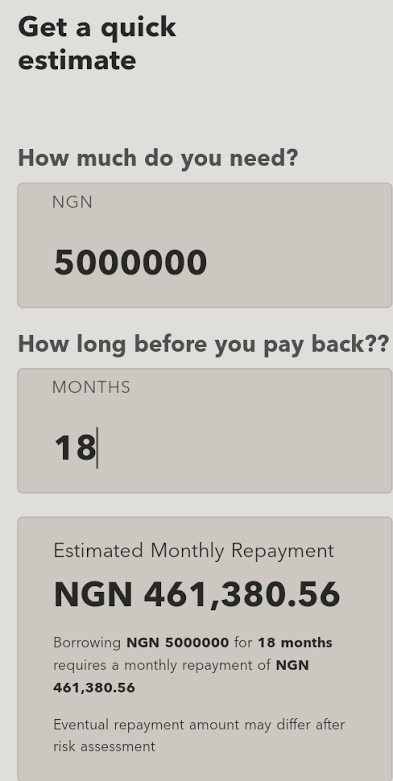

One of the tools that Renmoney offers to its customers is the Loan Calculator. A loan calculator is a tool that helps potential borrowers estimate how much they can borrow and what the repayment term will be. The loan calculator is made in such a way that it accurately predicts customers ‘ monthly repayment schedules. This prediction is based on how much the customer is planning to borrow and the repayment term they choose.

The loan calculator is an essential tool for anyone considering taking out a loan. Renmoney loan Calculator helps potential borrowers to plan their finances and also to make well-informed decisions about getting the loan. With the Renmoney Loan Calculator, customers can easily calculate loan costs, compare loan options, and choose the one that best suits their needs.

Renmoney is a reputable financial institution in Nigeria that offers excellent loan programs and the Loan Calculator is just one of the many tools they offer to help customers make informed borrowing decisions. . Whether you’re a first-time borrower or an experienced borrower, the Loan Calculator can help you plan your finances and choose the best loan option for your needs.

How to use Renmoney loan Calculator

To use the Renmoney loan Calculator follow the simple steps below.

- Start by visiting the Renmoney website or App, a trusted financial institution in Nigeria since its inception in 2012.

- Go to the Loan Calculator section of the website or App, where you will find a tool that allows you to calculate the loan repayment amount based on the loan amount, interest rate, and desired repayment period.

- Enter the relevant information about your loan, including the amount you want to borrow and the repayment term that works for you.

- Use the slider or the drop-down menu to adjust the interest rate and repayment period until you find a payment plan that meets your needs.

- After you have filled in all the required information, click the “calculate” button to estimate your monthly repayment amount.

- Review your loan calculations and adjust your loan amount and repayment period to arrive at a monthly payment you can comfortably afford.

Benefits of using Renmoney loan Calculator before borrowing a loan

Using Renmoney loan calculator comes with several advantages and we have carefully highlighted those benefits. Read below to see most of them.

- Save time – Using the Renmoney Loan Calculator before taking out a loan can save you valuable time. Instead of spending hours going through loan information and doing complicated calculations yourself, the Loan Calculator does all the heavy lifting for you.

- Accurate Estimate – Renmoney loan calculator provides an accurate estimate of your monthly payments, overall interest payments, and total loan cost. By using this tool, you can avoid being surprised by hidden fees or vague loan terms.

- Transparency – Transparency is one of Renmoney’s core values and the use of the Loan Calculator is proof of that. Loan Calculator gives you access to all the information you need to make an informed loan decision. This includes details about the payment schedule, interest rate, and term of the loan.

- Budgeting help – The loan calculator helps with budgeting by providing detailed information on how much you can borrow. It takes into account your income, expenses and other relevant information to provide you with accurate and useful budgeting information.

- User-friendly interface – Renmoney loan calculator is user-friendly which means you don’t have to be a financial expert to use it. The interface is intuitive and easy to navigate, making the loan process smoother and less stressful.

- Renmoney Trusted History – Renmoney has a trustworthy history as a trustworthy and responsible lender. By using their loan calculator, you can trust the accuracy and reliability of the information provided.

- Customizable Options – Customizable loan calculator that allows you to enter different loan amounts and terms to see their impact on your monthly payments and overall loan costs.

Using the Renmoney Loan Calculator before borrowing is a smart move. It saves time, provides accurate estimates, promotes transparency, facilitates budgeting, and has a user-friendly and customizable interface. Additionally, Renmoney’s reliable history as a responsible lender adds to the confidence you can have in their loan calculator.

Finally thoughts on Renmoney loan calculator

As I wrap up my discussion on the Renmoney Loan Calculator, allow me to share a bit of their story. Renmoney is a Nigerian fintech that offers various loan options to individuals and small businesses. They launched a loan calculator to help potential customers calculate their loan needs before applying for a loan.

Now, what is a loan calculator? It is a tool that helps you calculate the amount you will have to pay on a loan, including interest and payment period. This tool is designed to provide an estimate to help you make an informed decision about taking out a loan.

Renmoney is not the only financial institution offering this tool. However, their loan calculator has been designed to provide accurate results, making it easier for potential customers to plan for the future.

FAQs on Renmoney loan calculator

1) What is Renmoney and what services do they provide?

Renmoney is a financial institution that provides loans, savings, and investment options to individuals and small businesses in Nigeria.

2) What is a loan calculator and how does it work?

A loan calculator is a tool used to determine how much a borrower will have to pay over a certain period of time. It takes into account variables such as interest rate, loan term, and principal amount to provide an accurate repayment estimate.

3) How can I access Renmoney Loan Calculator?

To access Renmoney’s loan calculator, simply visit their website and find the loan calculator. Enter the desired loan amount, repayment term, and interest rate to get an estimate of your repayment plan.

4) How can Renmoney’s loan calculator help me with financial planning?

Renmoney’s loan calculator lets you know exactly how much you’ll have to pay, making financial planning easier and ensuring you can comfortably afford your loan repayments.

5) Can I use Renmoney Loan Calculator to compare loan options?

Yes, you can use Renmoney’s Loan Calculator to compare loan options and see which repayment plan is right for you. Simply adjust the loan amount, repayment term, and interest rate as needed.

Conclusion

In summary, the Loan Calculator is a useful resource for anyone looking to borrow money. When using Renmoney’s loan calculator, be sure to enter the correct loan amount and interest rate for accurate results. This tool will help you understand how much you will pay on a given loan, allowing you to make informed financial decisions.