P2vest Loan: interest rate, app download, customer care number

P2vest Loan: interest rate, app download, customer care number

P2vest Loan is a peer-to-peer (P2P) loan platform that was established in Nigeria in 2017. The platform is based in Lekki, Lagos, and it aims to provide quick and easy access to loans for individuals and small businesses who may not be able to secure loans from traditional financial institutions.

P2vest Loan is a legitimate business that is registered with the Corporate Affairs Commission (CAC) in Nigeria. The company’s registration number is RC 1454837, and it is also licensed by the Securities and Exchange Commission (SEC) as a Fintech Company. This means that P2vest Loan operates within the regulatory framework of the Nigerian financial industry.

The platform has received positive reviews from its users, who appreciate its fast loan processing times, competitive interest rates, and flexible repayment options. P2vest Loan also has a strong online presence, with a website and social media accounts that provide regular updates on its services and promotions.

However, as with any financial service, there are some risks associated with using P2vest Loan. Borrowers should be aware that the interest rates on loans can be higher than those offered by traditional banks, and there are fees associated with taking out a loan. Additionally, borrowers should carefully review the terms and conditions of their loan agreements to ensure that they understand the repayment schedule and any penalties for late payments.

P2vest Loan interest rate

P2vest understands that one of the most crucial factors that determine the appeal of a loan is the interest rate. Our platform offers competitive interest rates to both borrowers and investors, making it an attractive option for those seeking financing or looking to earn returns on their investments.

For borrowers, the interest rate on a P2vest loan depends on several factors, including the loan amount, repayment period, and creditworthiness. Generally, our interest rates range from 15% to 30% per annum, with lower rates available for borrowers with a strong credit history and collateral.

P2vest App download

If you’re looking to download the P2vest app, you’re in luck! Our user-friendly app is available for download on both the Google Play Store and the Apple App Store. Here’s how you can easily download the app:

- Google Play Store (for Android devices):

- Open the Google Play Store on your Android device

- Search for “P2vest” in the search bar

- Select the official P2vest app from the search results

- Click “Install” to begin downloading the app

- Once the download is complete, click “Open” to launch the app

- Apple App Store (for iOS devices):

- Open the App Store on your iOS device

- Search for “P2vest” in the search bar

- Select the official P2vest app from the search results

- Click “Get” to begin downloading the app

- Once the download is complete, click “Open” to launch the app

P2vest customer care number

Address: 9 Dauda Fasanya, Bexley Court, Ikate-Lekki.

Telephone. +234 702 500 3549 , +234 913 936 6498.

Email. info@localhost

FAQs

1. What is P2vest Loan and how does it work?

P2vest Loan is a peer-to-peer (P2P) lending platform based in Lekki, Lagos, Nigeria. It connects borrowers with lenders directly, eliminating the need for traditional financial institutions like banks. The platform allows individuals and businesses to borrow funds for various purposes, such as personal loans, business loans, and mortgage loans.

The process of obtaining a loan through P2vest Loan is simple. First, the borrower completes an online application form, providing details such as their employment status, income level, and loan purpose. The application is then reviewed by P2vest Loan’s credit team, who assess the borrower’s creditworthiness based on their financial history and other factors.

If the application is approved, the loan is listed on the platform’s marketplace, where lenders can choose to invest in the loan. The loan is funded by multiple lenders who earn interest on their investment over the loan term. The borrower repays the loan with interest to P2vest Loan, who then distributes the repayments to the lenders.

2. What are the benefits of using P2vest Loan compared to traditional banks?

There are several benefits of using P2vest Loan compared to traditional banks:

- a) Faster loan processing: P2vest Loan’s online application process is quick and easy, with most loans approved within 48 hours. Traditional banks can take weeks or even months to process a loan application.

- b) Lower interest rates: P2vest Loan’s interest rates are generally lower than those offered by traditional banks, making it more affordable for borrowers.

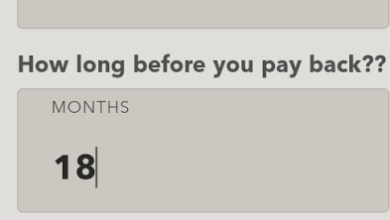

- c) Flexible loan terms: P2vest Loan offers flexible loan terms to suit different borrower needs, from short-term loans of a few months to long-term loans of several years. Traditional banks may have more rigid loan terms that do not fit every borrower’s situation.

- d) No collateral required: P2vest Loan does not require collateral for most loans, making it accessible to borrowers who do not have assets to use as collateral. Traditional banks may require collateral for certain types of loans.

3. How does P2vest Loan ensure the s toecurity of my personal information?

P2vest Loan takes the security of its users’ personal information very seriously. The platform uses advanced encryption technology to protect all data transmitted between users’ devices and its servers. Additionally, all user data is stored securely in compliance with industry-standard security protocols.