Lendly Loan Review: All You Need To Know (2023)

Lendly Loan Review: In this comprehensive Lendly Loan review, we will explore the features, application process, interest rates, pros and cons, and customer reviews of Lendly Loan. If you’re seeking a transparent and efficient lending solution, Lendly Loan could be the answer to your financial needs.

Read on to learn more about this trusted platform and how it can provide you with the financial assistance you require.

What is Lendly Loan?

Lendly Loan is an online lending platform that offers quick and convenient personal loans to individuals in need of immediate funds. Whether you’re dealing with unexpected expenses, consolidating debt, or planning a home renovation, Lendly Loan aims to provide a seamless borrowing experience.

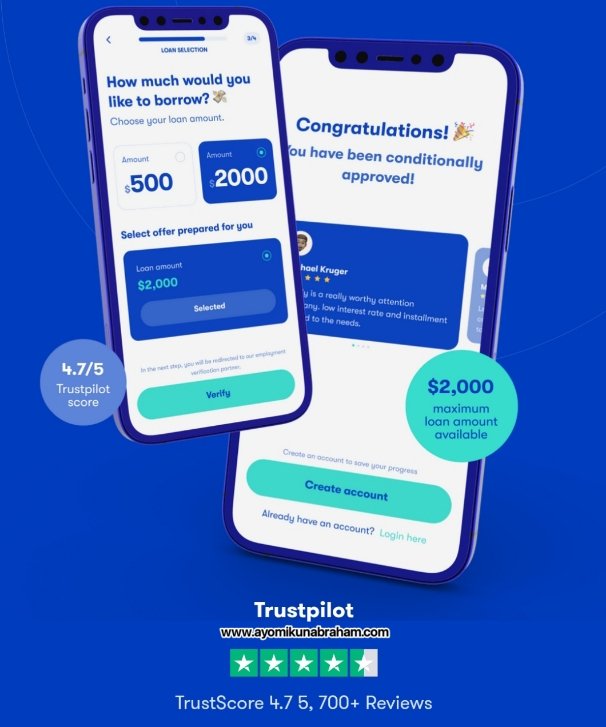

Lendly is a well-known company offering loans ranging between $500 to $2,000. But. that isn’t what makes Lendly loans so popular. The company enjoys 4.7 stars on Trustpilot and has a reputation for being reliable. Read more about Lendly loan here.

Features of Lendly Loan

Here we highlights and explain the features of Lendly loan, they are;

1. Fast and Easy Application Process

Applying for a loan with Lendly Loan is a breeze. The online application is simple, user-friendly, and can be completed within minutes. You’ll need to provide some basic personal information, including your income and employment details, to initiate the process.

2. Flexible Loan Options

Lendly Loan understands that everyone’s financial situation is unique. That’s why they offer a range of loan options to suit your specific needs. Whether you require a small loan to cover immediate expenses or a larger amount for a major investment, Lendly Loan has you covered.

3. Competitive Interest Rates

One of the key factors to consider when taking out a loan is the interest rate. Lendly Loan strives to provide competitive rates that are tailored to your individual circumstances. By utilizing their advanced algorithms, they can offer you an interest rate that aligns with your creditworthiness.

4. Transparent Terms and Conditions

Lendly Loan believes in transparency and aims to provide a clear understanding of the terms and conditions associated with your loan. Before finalizing your application, you will receive a detailed overview of the loan terms, repayment schedule, and any applicable fees. This ensures that you are fully informed and can make an educated decision.

5. Quick Funding

When faced with urgent financial needs, time is of the essence. Lendly Loan recognizes this and works diligently to provide fast funding solutions. Once your loan is approved, the funds can be deposited into your bank account within a short period, allowing you to address your financial obligations promptly.

Lendly loan review: How to Apply for Lendly Loan

Getting started with Lendly Loan is simple. Follow these steps to initiate the application process:

- Visit the Lendly Loan website and navigate to the loan application page.

- Provide the necessary personal information, including your name, address, contact details, and employment information.

- Input the desired loan amount and select the repayment term that suits your needs.

- Submit the application and wait for the loan decision.

- Once approved, review the loan terms and conditions and accept the offer.

- Upon acceptance, the funds will be deposited into your bank account, typically within one business day.

Lendly Loan Interest Rates

Interest rates play a significant role in determining the affordability of a loan. Lendly Loan strives to provide competitive rates based on your creditworthiness and financial profile.

It is important to note that interest rates may vary depending on various factors, including loan amount, repayment term, and your credit history. To get an accurate understanding of the interest rates offered by Lendly Loan, it is recommended to complete the application process and review the loan terms provided to you.

Pros and Cons of Lendly Loan

Before making a decision about any financial service, it’s crucial to consider the advantages and disadvantages. Here are some pros and cons of Lendly Loan to help you evaluate if it aligns with your borrowing needs:

Pros:

- Streamlined and user-friendly online application process.

- Flexible loan options to accommodate various financial requirements.

- Competitive interest rates based on individual creditworthiness.

- Transparent terms and conditions, ensuring clarity for borrowers.

- Quick funding, providing access to funds in a timely manner.

Cons:

- Availability of loan options may vary depending on your location.

- Loan approval and interest rates are subject to individual creditworthiness.

- Late or missed payments may result in additional fees or negative impact on credit score.

- Loans are subject to repayment obligations, which should be carefully considered.

Lendly Loan Reviews

Customer reviews provide valuable insights into the experiences of individuals who have utilized Lendly Loan’s services. While it’s important to consider that experiences may vary, here are a few snippets from satisfied Lendly Loan customers from Trustpilot:

- “Fair and reasonable policy!”

I made additional payments on top of the minimal payment believing that I would be eligible for a refinance soon. So once I reached the percentage to qualify, I requested to refinance. As it turns out, I wasn’t eligible. Obviously I was confused and upset but after speaking to customer service, they help me to make sense of their reasoning. Their policy is very fair and I respect it. But the good news is they explained how I WILL be able to qualify and what steps I need to take to get there! Thank goodness! ~ Christopher Garza from US (⭐⭐⭐⭐⭐)

Date of experience: June 01, 2023

-

“I’m very disappointed I have been waiting 6 days now for the funds they said I was approved I got to the screen to what my payments will be a never herd back. I was excited and had my hopes up but still haven’t herd back for this company very poor on commutation. Will not be referring to any of my friends or family” ~ Shana from US (⭐)

Date of experience: June 20, 2023

-

“Misleading”

Misleading, need person to person to confirm the terms before finalizing. Thought I was getting more than what I actually got. I wouldn’t have redone if I had been contacted to make sure that I knew that I was getting a lot less than what I thought. ~ Defref from US (⭐⭐)

Date of experience: June 12, 2023

-

“I received a flyer stating I was pre approved for a 2,000 loan. I did the application today and am waiting on an answer. I do know it went from 2,000 to 500.00

I will be fine with that but would like for it to be more. I had some problems with the application but a very nice lady helped me get it completed. Now just waiting.” ~ Dee from US (⭐⭐⭐⭐)Date of experience: June 21, 2023

-

“I Called about status of my application and was greeted by Brandon. He was so well spoken and helpful. He took the time to explain that my screenshots were revived and will be deposited into my account in file within 1-3 business days. He made me feel really confident with my application moving on into the next step of the application process. I really appreciated all of his help and patience. We need more representatives like Brandon he was amazing ????????” ~ Audrianna Jenkins from US [⭐⭐⭐⭐⭐]

Date of experience: June 15, 2023

Read more Lendly loan reviews on Trustpilot.

Loans like Lendly (Lendly Loan Alternatives)

Most Lendly loan reviews praise the platform for being a trustworthy lending option. Moreover, it is known for catering to people with poor credit scores. The company has clear eligibility requirements and loans are typically given on the basis of income and credit scores. However, unlike some other companies out there, it doesn’t put credit scores first.

While the company is reliable, most Lendly loan reviews call the lender out for charging higher than usual APRs. The average rate is 150 percent. The company is legit and has been doing business since 2019. It is a new company but it has carved a niche by offering great customer service and simple loans. However, it does not approve all applications and is known to reject borrowers who do not have a decent score or income.

This is the reason why most people look for loans like Lendly. They want the same easy eligibility requirements that Lendly offers but at a more affordable rate.

While Lendly Loan provides an excellent borrowing solution, it’s always beneficial to explore alternative options to make an informed decision. Here are a few alternatives worth considering:

Our number one option for loans like Lendly is Possible Finance. Even though the company was founded in 2017, it has made its name as one of the places you can turn to if you’re looking for more affordable rates than Lendly.

Through Possible Finance, you can borrow a loan of up to $500 and pay it back through the company’s app. However, this maximum loan amount may vary by state.

Here are the pros and cons of choosing Possible Finance as an alternative to Lendly loans:

Pros

- 85 percent loan acceptance rate

- No credit score requirements

- No late fee in case of a payment delay

- Offers instant cash

Cons

- Origination fee applies to loans and can vary by state

Possible Finance is for those who want loans like Lendly as it has very straightforward terms. Consider this option if you are looking for quick cash.

According to Lendly loan reviews, the company allows borrowers to lend up to $2,000. Prosper takes it a step ahead by offering up to $40,000 while keeping the same conditions as Lendly. However, the amount one gets largely depends on the credit score. The minimum is $2,000 but most borrowers will not qualify for $40,000. Those with an average score usually get approved for under $15,000. This is still a lot more than what Lendly offers.

While we have selected Prosper as a Lendly alternative, we must mention that it largely differs. Unlike Lendly, Prosper has flexible loan terms ranging from 3 to 5 years.

Here are the pros and cons of choosing Prosper Loans for loans like Lendly:

Pros

- Flexible loan terms

- Excellent customer support

- No repayment penalty

- Large loan amounts can be borrowed

Cons

- Charges late payment fees.

Prosper Loans has some great benefits and can be a reliable Lendly alternative. It is easy to work with and has simple requirements. Give it a try if you are looking for quick funds.

3. OppLoans

According to most Lendly loan reviews, it takes a minimum of 24 hours for an approved loan to be funded into your account when using Lendly. If you’re looking for loans like Lendly but with a faster funding time, then we recommend OppLoans.

Borrowers can get loans ranging from $500 to $4,000. Applications are processed in a few minutes and funds are released on the same day.

Loan terms are relatively manageable and range from 6 to 18 months. Terms typically depend on the size of the loan and are typically not flexible.

Here are the pros and cons of choosing OppLoans as your alternative for loans like Lendly:

Pros

- Same-day funding makes it a great option for people interested in quick cash

- No minimum credit score requirements

- Excellent customer support

Cons

- Not available in all US states

OppLoans is a Lendly loan alternative offering quick funding, but it is not the cheapest option out there. Also, loan terms may be too short for some. Hence, make sure to look at the fine print when you choose this company.

Final Thought

Lendly Loan offers a transparent and efficient lending platform, providing quick and convenient solutions for individuals in need of financial assistance. With a user-friendly application process, competitive interest rates, and fast funding, Lendly Loan stands out as a reliable choice.

Remember to carefully review the terms and conditions, consider your financial situation, and explore alternative options before making a final decision. Whether you’re facing unexpected expenses or planning for the future, Lendly Loan may be the answer to your financial needs.

FAQs: Lendly Loan Review

- Can I apply for a loan with Lendly Loan if I have a low credit score? Lendly Loan considers applications from individuals with varying credit scores. While a low credit score may impact the interest rate and loan terms, it is still possible to apply for a loan.

- How long does it take to receive the funds after loan approval? Once your loan is approved, the funds are typically deposited into your bank account within one business day.

- Are there any hidden fees associated with Lendly Loan? Lendly Loan believes in transparency and aims to provide clear terms and conditions. Before accepting the loan offer, you will receive a detailed overview of any applicable fees.

- What happens if I miss a loan payment? It’s crucial to make timely loan payments to avoid any negative consequences. Late or missed payments may result in additional fees and could potentially impact your credit score.

- Is Lendly Loan available in all states? Lendly Loan’s availability may vary depending on your location. It’s recommended to visit their website and check the eligibility criteria for your state.

Remember, it’s essential to review all terms and conditions, evaluate your financial situation, and compare alternatives before committing to any loan agreement.

One Comment